In 2015, Indian brands dominated India’s smartphone market, commanding 68% of the market share by volume.[1] Fast forward to 2021, and the share of Indian brands plunged to a mere 1 percent. Despite their earlier dominance, Indian brands could not keep pace with market trends, such as the move toward 4G connectivity. This shift raises significant questions: Why were Indian brands unable to compete or at least maintain their market shares despite their initial dominance? Why didn’t they innovate and upgrade faster even when they had the opportunity to do so?

The decline of Indian brands in smartphone manufacturing is not an aberration. India lags in innovation and advanced manufacturing across the board. For instance, India’s share of high-tech exports in its manufacturing basket is a mere 12%, while countries such as China, Israel, and Vietnam have shares of 23%, 22%, and 39%, respectively.[2]

India’s underperformance in innovation is puzzling because it is not a result of government neglect. The government invested in building science and technology capabilities soon after independence, even when it faced other developmental challenges. Government spending accounts for nearly 60% of total research and development (R&D) spending in India today and does not compare too unfavorably to other countries when normalized by GDP per capita.[3] The critical weakness is in-house industry R&D, substantially pulling down overall R&D spending.[4]

Given this paradox, our paper attempts to understand the policy impediments to technological upgrades and innovation that Indian firms face. We identify several policy hurdles, including high and arbitrary tax policies, a weak ecosystem for attracting and nurturing top talent, restrictive labor and protectionist trade policies, underperforming university research, reduced government support for private research, and lack of a robust intellectual property rights regime.

We begin our paper by discussing a framework that identifies different factors and variables to facilitate innovation using the lens of complexity. We then discuss India’s policy landscape in detail and identify policies that have hindered technology upgrades in Indian firms. Next, we explain the policy obstacles blocking innovation in India’s semiconductor ecosystem. The paper ends with our policy recommendations.

Innovation—A Complexity Analysis

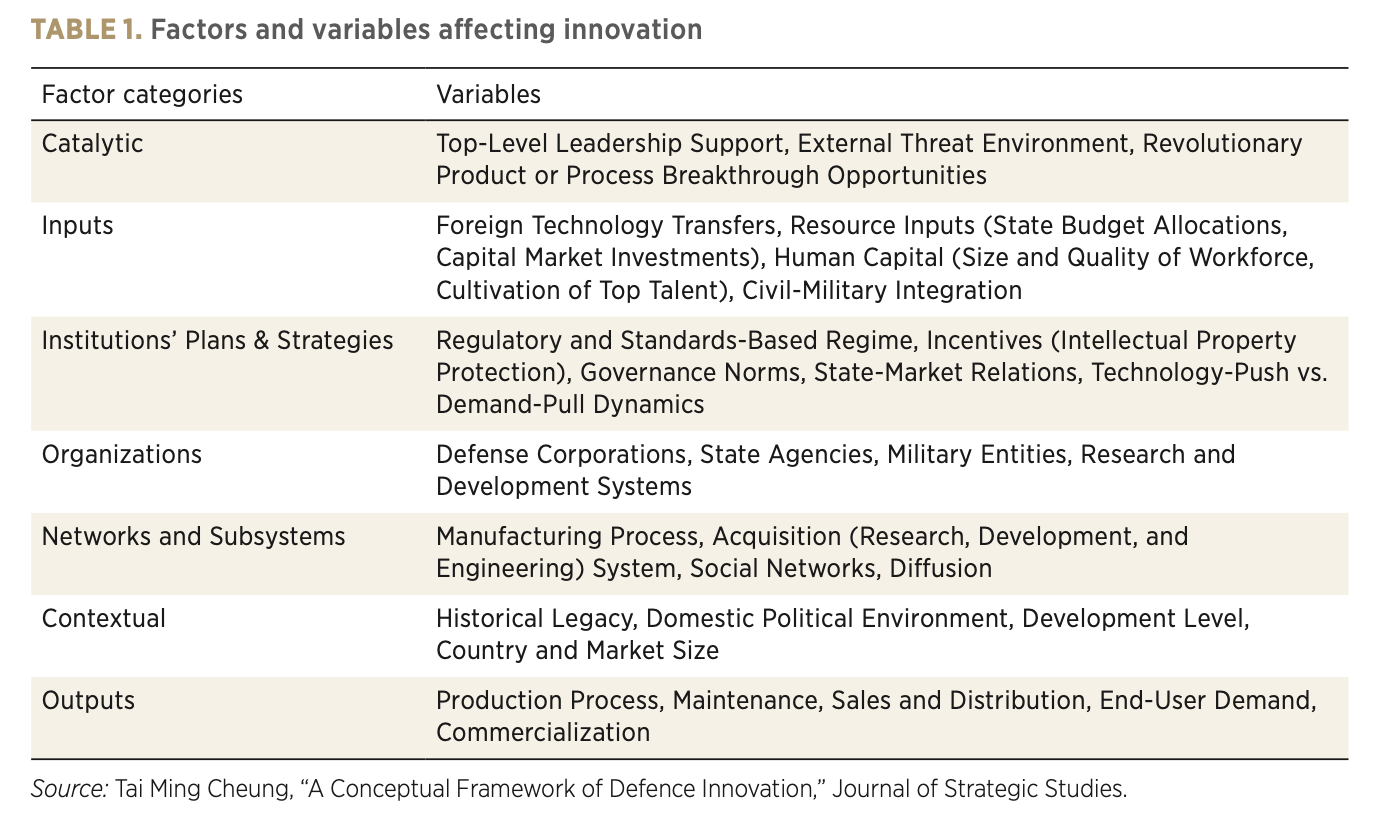

A policy regime that facilitates innovation is a system composed of numerous subsystems. The interaction among these subsystems leads to variations in innovation outcomes. In this section, we map the ecosystem that facilitates innovation. We deploy Tai Ming Cheung’s framework on defense innovation as a starting point to identify the factors and variables facilitating an innovation regime (table 1).[5]

Though table 1 identifies factors that lead to innovation, it does not show how different factors might influence one another. For instance, input factors such as the quality of the workforce can influence organizational factors such as corporations, and corporations can, in turn, affect the quality of the workforce. Similarly, institutional factors such as well-defined government procurement rules can help innovative firms thrive, leading to higher capital investments and, consequently, higher innovation.

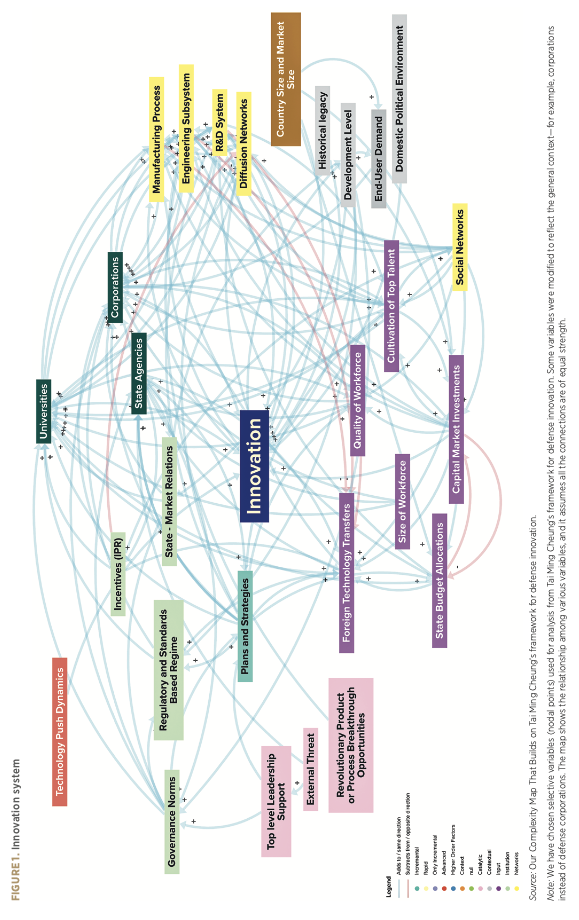

A complexity analysis can address these problems. Causal loops can identify systemic linkages and help us understand the root causes of Indian firms’ innovation underperformance. Mapping these linkages can also identify leverage points—that is, the factors that tend to have a significantly disproportionate, nonlinear influence on innovation outcomes.

In figure 1, we represent the causal linkages between these subsystems. We find three leverage points: corporations, universities, and R&D systems (figure 1). The analysis suggests that the government should prioritize these areas, as they will produce better results. Specific policy measures in these areas are detailed in the later sections of the paper.

Policies That Have Held India Back

In the previous section, we identified critical subsystems in the innovation ecosystem. This section looks at specific policies that have dampened India’s innovation.

Policy obstacles to investments

Innovation and technological upgrades require investments. However, private investment as a share of India’s GDP has declined in recent years (from 27% in 2011/12 to 19.6% in 2020/21).[6] Moreover, India’s R&D investment as a proportion of GDP remains notably low at 0.64%, as compared to countries such as China (2.4%), Germany (3.1%), South Korea (4.8%), and the United States (3.5%).[7] Examining the factors causing this decline is imperative.

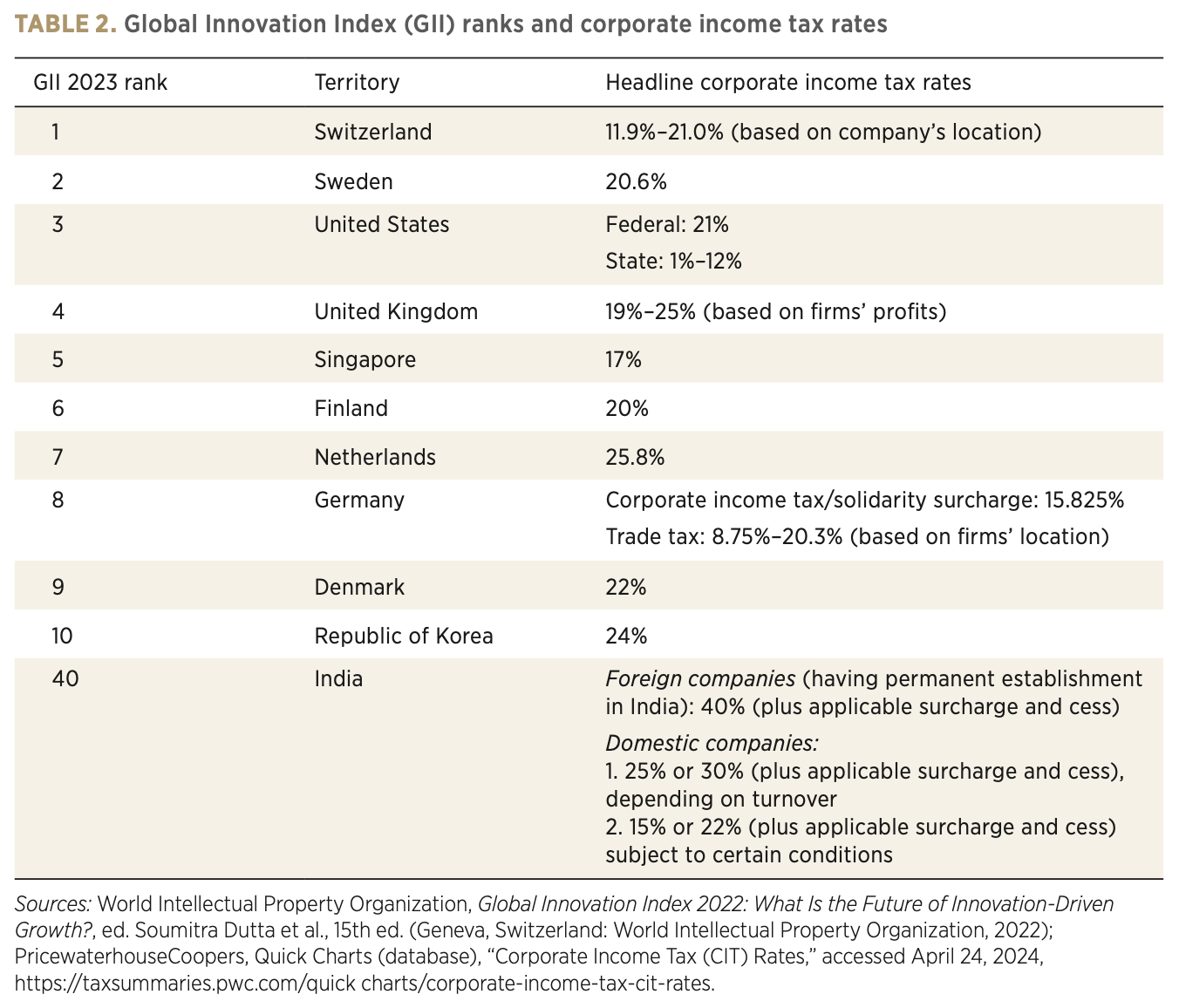

The first factor worth considering is India’s tax policies. Firms respond to tax rates. High tax rates lead firms to file fewer patents, invest less in R&D, and bring fewer new products to market.[8] Indian corporate taxes have traditionally ranked among the highest globally. In addition to paying the taxes, firms must pay surcharges and cesses.[9] A study by the Organisation for Economic Co-operation and Development (OECD) of 94 jurisdictions in 2018 revealed India’s statutory tax rate, including the tax on distributed dividends, to be the highest at 48.3%.[10] For years, Indian investors and shareholders have grappled with triple taxation due to the dividend distribution tax, which increased the effective corporate tax rate and undermined India’s attractiveness as an investment destination.[11] The policy regime improved only recently with a significant reduction of the corporate tax rate in the 2019 budget and the rollback of the dividend distribution tax in 2020.[12]

Despite these reductions, corporate tax rates in India are still high. As can be observed in table 2, the countries that tend to be the most innovative, as measured by Global Innovation Index rankings, typically have lower corporate tax rates. The corporate tax rates for foreign companies are exorbitantly high at 40% plus applicable cess and surcharge. High corporate taxes are also a reason for startups[13] to domicile themselves in low-tax jurisdictions.[14]

Tax rates are not only high but frequently perceived as arbitrary. For example, some tax laws are biased against domestic funds, contributing to the persistently smaller size of Indian investment vehicles compared to foreign ones.[15] This is primarily due to high taxes, ambiguity over the classification of gains, and the characterization of derivative gains as business income. For instance, India’s CAT III alternative investment funds collectively total $5.52 billion compared to $6.3 trillion for the world’s largest hedge funds. Regarding taxation of long-term capital gains, while foreign investors are taxed at 10%, domestic venture capital and private equity are taxed at 20%.[16] This serves as a disincentive for domestic capital investment.

Further aggravating the challenge for Indian investors and startups is the angel tax, governed by section 56(2)(viib) and section 68 of the Income Tax Act, 1961. Section 56(2)(viii) taxes Indian investments if the income exceeds fair market value.[17] Section 68 mandates a standard tax rate of 60%, resulting in an effective tax rate of approximately 78% when considering additional cesses and surcharges.

An expert-committee report submitted to the International Financial Services Centres Authority estimates that 56% of 108 unicorn startups are domiciled in offshore jurisdictions.[18] “Flipping,” or “externalization,” like this refers to “transferring the entire ownership of an Indian startup entity to an overseas entity, accompanied by a transfer of all IP and data hitherto owned by the Indian company.”[19] The report finds that flipping leads to the “movement of management, intellectual property, value creation, capital raising, etc., from India to the overseas jurisdiction.” Apart from factors such as an unstable regulatory environment, India’s high corporate tax rates (averaging 25.17%), compared to the other preferred jurisdictions (Singapore approximately 17%, the US approximately 21%, and the UK approximately 19%), play a significant role in this movement.

In addition to the high tax rates, the uncertainty surrounding overall taxation policies hampers corporate investments, in turn hindering innovation. Tax uncertainty can stem from various sources, such as a lack of precision in the tax code and frequent tax changes.[20] The uncertainty reduces firm innovation speed mainly by increasing information asymmetry between corporations and the government and reinforcing corporate risk aversion.[21] A recent example is the June 2023 amendment to section 65A of the Customs Tariff Act, 1962 to remove exemption from the integrated goods and services tax for inputs imported by a duty-free bonded warehouse meant for export production, and instead impose an 18% tax on such goods.[22] Following industry feedback, the government announced a partial rollback.[23] Such uncertainty discourages investors from making long-term, high-risk investments, which describes most R&D investments.

One mechanism for firms to hedge against the risks posed by an uncertain tax regime is to enter into unilateral or bilateral Advance Pricing Agreements (APAs). APAs provide certainty to taxpayers in transfer pricing and protect them from anticipated or actual double taxation.[24] India’s APA program has five-year agreements that can be extended for four more years. Since its inception, the program has received 1,659 applications. Only 516 of these agreements have been signed, with 81 percent being unilateral advance pricing agreements (UAPAs provide firms with less certainty compared to bilateral APAs).[25] Further, the APA administration is procedurally rigid.[26] Moreover, Indian APA teams lack expertise in multiple essential skills needed to navigate complex tax agreements. The second bottleneck to investments is India’s stance on bilateral investment treaties (BITs).[27] Once ratified, BITs typically boost bilateral foreign direct investment between the signatory countries compared to country pairs without BITs. Evidence suggests that lower-middle-income and low-income countries experience larger foreign direct investment flows from partner countries.[28]

India signed its first BIT in 1994. Between 1994 and 2015, India signed BITs with 83 countries, and 74 of these BITs were enforced. After receiving an adverse award in White Industries v. Republic of India under the India–Australia BIT, India approved a new BIT model in 2015. The new model leaves out some well-recognized international provisions, such as fair and equitable treatment and most-favored-nation clauses. It requires investors to exhaust local and domestic remedies, including invoking the jurisdiction of the host country’s domestic courts for a minimum of five years before resorting to arbitration under the treaty.

In a report, India’s Standing Committee on External Affairs described “the number of BITs/Investment Agreements signed post 2015 and the number under negotiations as inadequate,” explaining that “it was not commensurate with the growth of India’s interest in this domain and our rising stature in global affairs.”[29] After approving the new model, India signed new BITs with only four countries (Belarus, Kyrgyzstan, Taiwan, and Brazil), while it terminated its older BITs with 77 countries. A recent study found a notable decrease in foreign direct investment inflows from the countries with which BITs were terminated by India.[30] A decline in the number of BITs can reduce corporate investments and hinder foreign technology transfers.

Policy obstacles to attracting talent

Apart from investments in physical capital, human capital is another crucial ingredient for driving innovation. Innovation thrives when top talent is nurtured and supported. India’s education system acts more like a sorting and selection mechanism than a human-development mechanism.[31] The system does reasonably well in screening the top talent—but fails to retain it.

A paper published by the National Bureau of Economic Research (NBER) in the United States finds that 36% of the top 1,000 scorers on the Indian Institute of Technology’s Joint Entrance Examination in 2010 have migrated abroad.[32] Among the top 100 scorers, the percentage is 62%. The higher the student’s rank, the higher the likelihood of their emigrating. India contributes the largest high-skilled diaspora to OECD countries.[33] Recently, India has lost the highest percentage of dollar millionaires as a result of migration.[34] And far from being an attractive destination for talent, India ranks 132nd out of 134 countries according to the Global Talent Competitiveness Index.[35]

Additionally, India struggles to attract foreign talent, as is evident in its low expat population of just 0.4%.[36] The ability to attract foreign talent or encourage skilled diaspora members to return depends on various factors, including living standards and the quality of opportunities available for spouses.[37] India does not perform well on these counts. The Expat Insider Survey 2023, conducted by InterNations, points out that India has consistently ranked in the bottom 10 on the quality-of-life index.[38]

Highly skilled and qualified talent must be complemented by a large-enough skilled labor force. Though India has the second-largest labor force in the world,[39] the quality of the labor force is poor. India ranks 129th of 162 countries in terms of the extent of skilled labor, with just one out of five workers being skilled.[40] Lack of skills affects the productivity of the workforce and economy.

Per International Labour Organization data, India’s labor productivity is one-ninth, one-fifth, and one-half that of the US, South Korea, and China, respectively.[41] Industrial value added per worker in the US, Japan, and South Korea is 4.2, 3, and 2.7 times that of India.[42]

Policy obstacles to firms scaling up

Besides investments and human capital, policies and ecosystems conducive to firm scalability are also crucial for fostering innovation. A supportive environment enables firms to envision larger markets and incentivizes them to bear the fixed costs associated with innovation. Conversely, restrictive regulations and protectionist measures may stifle growth, resulting in firms that fail to scale up.[43] Studies on labor regulations indicate that when a country’s labor regulations become more restrictive, manufacturing output, investment, and productivity in the formal sector decrease.[44] In line with this, Hasan and Jandoc’s study highlights that countries with rigid labor laws tend to have fewer larger firms.[45] These restrictive regulations prevent Indian firms from growing, limit their profitability and growth, and hinder innovation. India has long been known for its excessively restrictive labor laws.[46] However, in 2020, India took steps to streamline its labor regulations by consolidating 29 of its 44 legislations into four new codes. The implementation of these new rules is still pending.

Openness to international trade spurs innovation through various means.[47] International trade expands the size of the accessible market, increasing the incentive for firms to incur the fixed cost of innovation. Firms are incentivized to innovate to beat the competition. Additionally, international trade leads to knowledge spillovers, facilitating innovation through diffusion. Despite these potential gains, the Indian government disfavored freer trade arrangements after independence and imposed heavy import restrictions in the form of tariff and nontariff barriers.[48] Even today, India’s absence from major trading blocs curtails the ambitions of its firms. For instance, India’s decision to opt out of the Regional Comprehensive Economic Partnership has limited Indian firms’ access to cheaper intermediate inputs and a large market representing 30% of the world’s population and contributing 30% of global GDP. This has reduced Indian firms’ role in global value chains.[49]

Policy obstacles to research

One of the mechanisms governments use to incentivize private firms to invest in R&D is to provide R&D credits. The premise is that if R&D is left entirely in the hands of private sector enterprises, these enterprises will underinvest in it.[50] Given that the societal benefits of R&D surpass the private benefits, there is a case for the government to finance R&D.

For a long time, India has been providing R&D tax credits. Until 1998, firms with in-house R&D units were eligible for a 100% tax deduction on their current and capital R&D expenditures. Over time, the tax regime concerning R&D has evolved. Newer industries, such as pharmaceuticals and electronics components, became eligible in 1998. The R&D tax incentive increased to 150% in 2000/01 and then to 200% in 2010/11. Jain and Singh’s study of the R&D tax credits between 1992 and 2007 finds the credits to be effective in stimulating private R&D spending.[51] They also suggest these tax credits increase competition between firms and industries. Another study reveals that the 200% weighted tax-incentive scheme does not significantly affect very large firms (the top 20 firms) but does stimulate the R&D investments of small and medium firms.[52] Despite the positive findings, India progressively reduced R&D tax incentives from 200% in 2016/17 to 100% by 2020/21.

A thriving R&D ecosystem is essential for innovation. Talent policies to attract highly skilled individuals can help create a world-class science system. For instance, China has initiated a set of programs (for example, the Thousand Talents program) targeting Chinese researchers abroad who have overseas training and work experience. Some initial estimates find that China has been able to attract more than 7,000 researchers to return to China between 2011 and 2021 following the program’s expansion.[53] A recent paper points out that “Chinese returnees publish higher impact work and continue to publish more and at the international level than domestic counterparts.” The returnees publish with researchers in their former host system, thereby linking China to the global network of scholars.[54]

India lacks the policy and academic environment needed to implement talent policies such as those mentioned above. One key issue is the absence of high-quality research universities in the country. Much of India’s research is confined within Soviet-style labs and government bodies that operate independently from universities, resulting in a disconnect between academia and research institutions. In the United States, renowned for its vibrant R&D ecosystem, academia receives 30% of federal research and development funding. In contrast, academia receives only 5% of such funding in India, with government bodies receiving 90%.[55] Furthermore, government bodies conduct R&D themselves, without focusing on contracting out, which leads to various limitations such as inefficiency, inability to harness the benefits of competition, and insufficient knowledge spillovers to society.[56]

Policy obstacles to intellectual property creation

Historically, India did not have a robust intellectual property rights (IPR) regime. For instance, until 2005, India’s patent laws recognized only process patents and not product patents. This policy discouraged firms from developing new products, leading them to focus on replicating products that had already been “researched and productionized” elsewhere.[57] An apt example is the pharmaceutical sector, in which India has prioritized reformulation and process engineering/reengineering to become the leader in producing generic drugs but has simultaneously performed poorly at novel drug development.[58]

After 35 years under a process-patents system, India revised its patent laws to comply with the Trade-Related Aspects of Intellectual Property Rights Agreement and began recognizing product patents[59]. Despite this significant shift, the IPR regime has faced various challenges,[60] such as a lack of sufficient examiners and a lack of expertise.[61] The average time taken for patent disposal in India is about five years, as compared to the global best practice of two to three years.

Further, the stringent penal provisions[62] and inflexibility[63] in the patent laws hamper patent filings. The dispute resolution mechanism is also slow because of its reliance on an overburdened judicial system. The Intellectual Property Appellate Board, responsible for hearing appeals of decisions by the Controller of Patents, performed suboptimally, mainly because of undue delays in appointing its members and experts. Instead of addressing these issues through timely appointments and enhancing the board’s expertise, the board was abolished in 2021, and its jurisdiction was transferred to already-overburdened high courts.[64]

In recent times, the IPR regime’s capacity has improved, best reflected in increased patenting activity, but India still lags far behind its peers.[65] Augmenting the capacity of the IPR regime will facilitate the development of new technology.

Policy Bottlenecks Impeding India’s Semiconductor Ecosystem: A Case Study

This section illustrates the policy bottlenecks discussed in the first two sections in the context of India’s semiconductor ecosystem. Since the semiconductor supply chain spans high-end manufacturing, intellectual property–driven design, and large-scale assembly, this case study can shed light on both innovation-hindering and innovation-enabling policies.

For simplicity, we divide the semiconductor supply chain into three segments: design, fabrication, and assembly. Chip design is a human-capital- intensive stage in which blueprints of semiconductor chips are created. This stage needs human capital, patient venture capital, and a supportive intellectual property ecosystem. Chip fabrication is the capital-intensive segment in which digital chip blueprints are converted into physical chips. The entry ticket for this segment is billions of dollars of upfront investment that can generate revenue only after long gestation periods of two to four years. The high capital-investment requirement means that government stances related to policy, tax, and trade affect this segment disproportionately. Finally, the assembly, testing, and

packaging segment is a labor-intensive segment in which chips manufactured elsewhere are assembled in a manner that allows them to be connected to the rest of the electronic device. As a result, labor and trade policies have an outsize effect on this segment.

India accounted for roughly 10% of global semiconductor consumption, and over 90% of semiconductors in India are imported.[66] But despite several attempts to build a semiconductor ecosystem since the 1960s, Indian firms have not been able to climb the innovation ladder as their peers in Japan, South Korea, China, and Taiwan did.[67] The reasons can be easily mapped onto the complexity map shown in figure 1.

Policy hurdles in the chip-design segment

India has long had a comparative advantage in this segment because of its human-capital-heavy nature. It is estimated that 19% of chip-design engineers are in India[68]. All of the top-10 chip design companies by revenue have an offshore chip design centre in India, the first of which began nearly forty years ago in 1985. In a comparative analysis of design capabilities between India and China, Douglas Fuller finds that these offshore design centres had a positive impact. Indian engineers were ahead in 2010 in terms of the complexity of chip designs handled and in filing patents.[69] Despite these advantages, India has a disproportionately small number of chip-design firms. The total revenue of domestic semiconductor-design companies is minuscule, estimated to be less than $50 million in 2021. In contrast, the total income of Chinese fabless semiconductor companies grew to $24.4 billion by 2020.[70] We can locate the causes of this divergence in many of the policy conditions identified in the previous section.

A robust university-industry linkage is a key leverage point for creating breakthrough chip-design ideas. Though India produces a large number of qualified engineering students annually, it does not produce enough post-graduates or PhDs in semiconductor-related fields (a mere 8% of graduates). Many of them move out of India to pursue higher education in other countries and join chip-design firms there. Back-of-the-envelope calculations suggest that nearly 40% of the world’s chip-design talent is of Indian origin. Fixing the foundational research ecosystem by rejuvenating very large-scale integration (VLSI) research in universities is thus necessary for success in this segment.[71]

A policy change that could help in the short term would be incentivizing experienced Indian-origin engineers to consider redomiciling their chip-design companies in India. Existing policies have overly restrictive conditions regarding Indian ownership for accessing government grants, such that even firms set up by Indian-origin entrepreneurs that have design offices in India do not qualify. Such incentives should be available to all startups with registered chip-design offices in India. As long as the financial incentive is transferred to an Indian private limited entity, it will help companies deepen their presence in India.

Another issue holding the chip-design companies back is India’s unfavorable trade policy. Because of antidumping policies, domestic semiconductor-design firms find importing secondhand tools used in the chip- design process burdensome. These tools include thermal and sensor simulation tools. This friction places an extra financial burden on chip-design startups.

The third significant reason for India’s laggard chip-design segment is the lack of a venture capital ecosystem. Unlike the software industry, the semiconductor industry has an extended gestation period for return on investments. With at least three years required for a final product to go out into the market, semiconductor-design firms cannot attract potential investors and venture capitalists the same way software companies do. Even design companies that manage to overcome these hurdles prefer to raise investments from the West, where valuations are likely to be of an order higher than in India. At the margin, the higher policy uncertainty further exacerbates the trend of investors preferring to finance software firms with low turnaround times over chip-design firms.

Policy hurdles in the chip-fabrication segment

As a capital-intensive segment with long gestation periods, the chip-fabrication segment places policy, tax, and trade consistency at a premium. In his report on India’s semiconductor readiness, Stephen Ezell argues that leading semi-conductor manufacturers consider almost 500 discrete factors before making multibillion-dollar fabrication investments.[72]

In the preliberalization era, government-run fabrication units could not keep pace with the high capital requirements. After liberalization, the government attempted to attract foreign fabrication firms through programs promising financial incentives and government support. However, an uncertain tax and policy environment, poor infrastructure, and high trade barriers turned investors away. The retrospective-taxation cases mentioned in the previous section especially left a wrong impression on potential investors.

In the latest attempt, which began in 2021, the government has upped the stakes. State and union governments are willing to offer upfront support of around 70% of a fabrication project’s total cost. This kind of support is unprecedented for India and reflects how investors view India as a destination for chip fabrication. Despite this focus, only one project has received approval thus far. None of the top three semiconductor-fabrication companies have shown interest. The one fabrication facility that is coming to Dholera at a cost of nearly $11 billion is significantly costlier than industry benchmarks,[73] perhaps reflecting the cost disabilities arising from the unavailability of infrastructural factors such as clean water and reliable electricity.

Frequent changes in tax policies have been flagged as another concern. Recent actions by tax authorities against Chinese and South Korean mobile phone brands have heightened the risk for foreign companies in the broader electronics sector.

Policy hurdles in the chip-assembly segment

Assembly plants (also known as back-end fabs) test the manufactured chips for defects and ensure protective packaging for all finished chips. This stage requires high capital investment and high-skilled engineering talent, though not of the same order as fabs. But more importantly, this stage also requires relatively low-skilled labor for the assembly lines. With low-skilled labor more available in India than elsewhere, many leading global firms, such as ASE Technology and Powertech Technology, would benefit by offshoring these operations to India. That has not happened. While three projects have been approved, major Taiwanese players have opted to set up new facilities in Malaysia, Vietnam, and the Philippines.

A stated reason for these companies choosing to set up assembly plants elsewhere is India’s trade policy. For example, Taiwanese officials have asked for tariff reductions on products used for making semiconductors because the assembly segment would lead to an increase in imports of machines and unpackaged chips. Further, Taiwan has also filed a case against India for violating the World Trade Organization’s agreement on tariff reductions. Taiwan’s minister of foreign affairs stated that India must sign the long-pending free trade agreement with Taiwan, which would pave the way for companies to import components, equipment, and materials quickly.[74]

Restrictive labor laws have also proven to be significant deterrents for investors. Taiwanese firms are used to operating with two 12-hour shifts rather than three eight-hour shifts. However, this remains a sensitive issue for the governments of many countries.

This case study illustrates the range of challenges that India faces in semi-conductor technology upgrading. No one policy solution can resolve all these challenges. In fact, most of the solutions are outside the ambit of the ministry in charge of the sector’s development and regulation.

Key Focus Points

Based on the complexity analysis and the case study, we arrive at three leverage points: corporations, universities, and R&D systems. Prioritizing these domains would lead to significant gains in innovation.

Regarding corporations, the government must prioritize creating an enabling policy environment that attracts both foreign and domestic investments and facilitates their scaling up. Effective policy mechanisms in this regard could include reducing tax rates and enhancing tax certainty by improving the country’s capacity for concluding APAs and BITs. The policy environment must remove impediments that prompt startups to relocate outside India, such as arbitrary treatment. Additionally, the government should remove restrictive labor legislation that is out of step with the current realities.

Regarding universities, India’s innovation system needs to tap into the intellectual capital of top talent outside India. However, given India’s current developmental stage, enticing these researchers may prove challenging. The decision to relocate is influenced by multiple factors, including quality of life and opportunities available for spouses. Special fellowships or monetary incentives, similar to those employed by China, might not be sufficient to persuade individuals to move to India permanently. Additionally, such incentives can lead to contentious situations, including allegations of intellectual property theft and espionage from the host countries. Given these constraints, the most viable approach would be facilitating collaboration between Indian researchers abroad and those in India. It could be achieved through joint research programs and by establishing hubs of excellence in geopolitically favorable and livable locations such as Dubai, Singapore, or Melbourne.[75]

The current higher education regulatory environment diminishes the ability of private players to respond to market needs, resulting in decreased investments and competition in the sector, which limits innovation potential.[76] Simplifying the regulatory approval process and enabling higher participation of foreign universities in the economy can help alleviate these challenges.

Given the pivotal roles that universities and corporations hold in an economy’s R&D ecosystem, the policy recommendations outlined above will also help improve the R&D ecosystem. In addition to these measures, the government could explore enhancing R&D tax incentives to scale innovation. Technology transfers from geopolitically favorable partners such as the Quad countries could also propel India’s R&D system to the next level.

If India desires to keep pace with the global demand for more agile and sophisticated technology, it should take steps toward a policy environment that attracts investment and enables innovation. Changing outcomes in a complex system, however, requires general-equilibrium thinking and interministerial coordination. Though complex and challenging, we believe that it is possible for India to become a major industrial player by enacting the policy recommendations outlined below.

Policy Recommendations

This section lists specific policy changes that could have a disproportionate positive impact on India’s innovation ecosystem.

The government must consider reducing tax rates. It can bring in necessary amendments through the Finance Act to further reduce effective corporate tax rates. Additionally, it should remove the disparity in the taxation of long-term capital gains between foreign and domestic investors by amending section 112 of the Income Act of 1961. It should seek to reduce the compliance burden by establishing a threshold below which investments are exempt from scrutiny under section 68 and section 56(2)(viib) of the Income Tax Act.

To improve policy certainty, the Central Board of Direct Taxes must consider allocating additional human resources with subject matter expertise to expedite the negotiation of APAs. It should consider drafting Standard Operating Procedures (SOP) and manuals to foster policy consistency. The government should draft a new model BIT to allow for an easier arbitration process.

The government should also consider measures to leverage top talent in geopolitically favorable locations (e.g., Dubai, Singapore, or Melbourne) by setting up centers of excellence and offering fellowships to attract these individuals. Both the union and state governments must gradually simplify the process of establishing universities. While the governments need to support higher education institutions, they must avoid micromanagement.

Additionally, the union government should incentivize private firms’ in-house R&D spending through higher tax credits and contracting out more R&D activities. Modifying the General Financial Rules can facilitate the process of acquiring R&D tax credits.[77]

Finally, India needs to make its IPR regime more robust. This can be achieved by increasing the number of officials with subject matter expertise, amending section 21(1) of the Patent Act to allow for revised petitions, removing the penal provisions under section 122(2) that lead to imprisonment, and establishing an Intellectual Property Appellate Board with sufficient capacity to settle disputes.

Conclusion

One way to address the problem of India’s lack of innovation is to focus on a specific industry domain and identify narrow policy “recipes.” Instead of this approach, in this paper, we identified systemic linkages using complexity theory to pinpoint the policy “ingredients” that have hindered technological upgrades and innovation. Based on this analysis, we have identified solutions that, if implemented, could help India transition to a more innovative and advanced industrial landscape.

Notes

[1] Krishna Veera Vanamali, “How Did Chinese Smartphones Wipe out Indian Brands?,” Business Standard, January 19, 2022.

[2] World Bank, World Bank Open Data (database), “World Bank Open Data,” accessed July 16, 2024, https://data.worldbank.org/indicator/TX.VAL.TECH.MF.ZS

[3] “How India Can Become a Science Powerhouse,” Nature 628, no. 8008 (April 16, 2024): 473.

[4] Naushad Forbes, “R&D: An Inside Job,” Business Standard, February 15, 2023.

[5] Tai Ming Cheung, “A Conceptual Framework of Defence Innovation,” Journal of Strategic Studies 44, no. 6 (September 19, 2021): 775–801.

[6] Prashanth Perumal J., “Why Have Private Investments Dropped? | Explained,” The Hindu, April 18, 2024.

[7] Animesh Jain and Anurag Anand, “India’s R&D Funding, Breaking down the Numbers,” The Hindu, March 13, 2024.

[8] Abhiroop Mukherjee, Manpreet Singh, and Alminas Žaldokas, “Do Corporate Taxes Hinder Innovation?,” Journal of Financial Economics 124, no. 1 (April 1, 2017): 195–221.

[9] Adam Hussain, “Effect of Tax Cut on Investment: Evidence from Indian Manufacturing Firms” (National Institute of Public Finance and Policy Working Paper, National Institute of Public Finance and Policy, New Delhi, India, February 2023).

[10] Organisation for Economic Co-operation and Development, Corporate Tax Statistics (Paris, France: Organisation for Economic Co-operation and Development, 2019).

[11] Siddarth M. Pai and T. V. Mohandas Pai, “Indian Govt Must End Triple Taxation,” Financial Express, November 21, 2019.

[12] Niti Kiran, “Has India’s Corporation Tax Gamble Paid Off Yet?,” Mint, March 26, 2023.

[13] In this paper, “startups” refer to firms designed to grow rapidly and disrupt their sector. In contrast, “small firms” refer to companies that do not aim for rapid growth or sector disruption but restrict themselves to finding a market for themselves and earning revenue.

[14] International Financial Services Centres Authority, Onshoring the Indian Innovation to GIFT IFSC. (Gandhinagar, India: International Financial Services Centres Authority, August 2023).

[15] T. V. Mohandas Pai, “Tax Reforms: Need to Revisit Anti-Indian Taxation Laws,” Financial Express, August 30, 2019.

[16] Siddarth Pai and T. V. Mohandas Pai, “Onshoring Indian Innovation,” Financial Express, February 1, 2023; Committee on Finance, Ministry of Finance and Ministry of Commerce, Financing the Startup Ecosystem, September 2020, https://eparlib.nic.in/bitstream/123456789/799187/1/17_Finance_12.pdf.

[17] Suprita Anupam, “The Angel Tax Paradox: The Unending Saga for Indian Startups,” Inc42, October 2, 2023.

[18] International Financial Services Centres Authority, Onshoring.

[19] International Financial Services Centres Authority, Onshoring.

[20] Ernesto Zangari, Antonella Caiumi, and Thomas Hemmelgarn, “Tax Uncertainty: Economic Evidence and Policy Responses” (Taxation Papers Working Paper no. 67–2017, Brussels, Belgium: European Commission, 2017).

[21] Wanyi Chen and Rong Jin, “Does Tax Uncertainty Affect Firm Innovation Speed?,” Technovation 125, article 102771 (July 1, 2023).

[22] Another notable case is the change to the Income Tax Act in 2012 that made nonresidents and companies outside India liable for taxes if they were involved in share transfers related to Indian assets. The change was made to impose a tax liability on Vodafone for its acquisition of Hutch Hutchison’s Whampoa business. The case went to The Hague, where Vodafone won.

[23] Stephen Ezell, Assessing India’s Readiness to Assume a Greater Role in Global Semiconductor Value Chains (Washington, DC: Information Technology and Innovation Foundation, February 14, 2024).

[24] Ministry of Finance, “CBDT Signs 95 Advance Pricing Agreements in FY 2022–23,” Press Information Bureau Delhi, March 31, 2023.

[25] Central Board of Direct Taxes, Income Tax Department, Advance Pricing Agreement (APA) Programme of India Annual Report (2022–23) (New Delhi, India: Ministry of Finance, September 2023).

[26] Sobhan Kar, Aaron Wang, and Michael Sun, “APA Implementation in India and China under the Spotlight,” Deloitte, November 4, 2022.

[27] Committee on External Affairs, “Fourteenth Report of the Committee on External Affairs (17th Lok Sabha),” July 2022, https://eparlib.nic.in/bitstream/123456789/931959/1/17_External_Affairs…

[28] Arjan Lejour and Maria Salfi, “The Regional Impact of Bilateral Investment Treaties on Foreign Direct Investment” (CPB Discussion Paper 298, CPB Netherlands Bureau of Economic Policy Analysis, The Hague, Netherlands, January 2015); Tim Büthe and Helen V. Milner, “Bilateral Investment Treaties and Foreign Direct Investment: A Political Analysis,” in The Effect of Treaties on Foreign Direct Investment: Bilateral Investment Treaties, Double Taxation Treaties, and Investment Flows, ed. Karl P. Sauvant and Lisa E. Sachs (New York: Oxford University Press, 2009), 171–224.

[29] Committee on External Affairs, “Fourteenth Report.”

[30] Elena Kotyrlo and Hryhorii M. Kalachyhin, “The Effects of India’s Bilateral Investment Treaties Termination on Foreign Direct Investment Inflows,” Economics of Transition and Institutional Change 31, no. 4 (October 2023): 1007–33.

[31] Karthik Muralidharan, “Reforming the Indian School Education System,” in What the Economy Needs Now, ed. Abhijit Banerjee et al. (New Delhi, India: Juggernaut, 2019).

[32] Prithwiraj Choudhury, Ina Ganguli, and Patrick Gaulé, “Top Talent, Elite Colleges, and Migration: Evidence from the Indian Institutes of Technology” (NBER Working Paper No. 31308, National Bureau of Economic Research, Cambridge, MA, June 2023).

[33] Rohen d’Aiglepierre et al., “A Global Profile of Emigrants to OECD Countries: Younger and More Skilled Migrants from More Diverse Countries” (OECD Social, Employment and Migration Working Papers No. 239, Organisation for Economic Co-operation and Development, Paris, France, February 20, 2020).

[34] Rohan Puri, “The Great Indian Migration: Why Are the Rich Leaving the Country?,” The Quint, May 24, 2022.

[35] INSEAD, The Global Talent Competitiveness Index 2023, ed. Bruno Lanvin and Felipe Monteiro (Fontainebleau, France: Institut Européen d’Administration des Affaires, 2023).

[36] Kim McClatchie, “Trickiest Countries for Expats to Relocate to,” William Russell (blog), February 21, 2024.

[37] Pranay Kotasthane, “India Watch #2: Swades sans the Heroism,” Anticipating the Unintended, June 11, 2023, https://publicpolicy.substack.com/i/126911276/india-watch-swades-sans-t….

[38] “India Ranked 36th out of 53 in Expats’ Choices to Work,” editorial, Times of India, July 12, 2023.

[39] Helgi Library (database), “Which Country Has the Largest Labour Force?,” February 1, 2023, https://www.helgilibrary.com/charts/which-country-has-the-largest-labour-force.

[40] “With 1 in 5 Workers ‘Skilled,’ India Ranks 129 among 162,” editorial, Times of India, December 17, 2020.

[41] International Labour Organization, ILOSTAT (database), “Statistics on Labour Productivity,” accessed April 22, 2024, https://ilostat.ilo.org/topics/labour-productivity/.

[42] World Bank, World Bank Data (database), “Industry (Including Construction), Value Added per Worker (Constant 2015 US$)—India, China, Viet Nam, United States,” accessed April 22, 2024, https:// data.worldbank.org/indicator/NV.IND.EMPL.KD?end=2019&locations=IN-CN-VN-US&start=1995.

[43] Policies such as “Items Reserved for Manufacture Exclusively by the Small-Scale Sector” actively discouraged technological upgrades. Reserved sectors also included electrical and electronics appli- ances. An advisory committee (in 1995) pointed out that “product improvement or innovation has not taken place on account of limited R&D and negligible competition from within the country or abroad. Local R&D was also restricted on account of a protective market.” By 2015, only the last 20 items on this list were removed.

[44] T. Besley and R. Burgess, “Can Labor Regulation Hinder Economic Performance? Evidence from India,” Quarterly Journal of Economics 119, no. 1 (February 2004): 91–134.

[45] Rana Hasan and Karl Robert L. Jandoc, “Labor Regulations and the Firm Size Distribution in Indian Manufacturing” (School of International and Public Affairs Working Paper No. 1118, Columbia University, New York, revised January 2012).

[46] Devashish Mitra, “Impact of Labour Regulations on Indian Manufacturing Sector,” Ideas for India, November 2, 2022.

[47] Marc Melitz and Stephen Redding, “Trade and Innovation” (NBER Working Paper No. 28945, National Bureau of Economic Research, Cambridge, MA, June 2021).

[48] Anupam Manur, “From Protectionism to Global Integration: India’s Trade Policy before and after 1991” (Annals of Computational Economics, Mercatus Center at George Mason University, Arlington, VA, 2022).

[49] New Zealand Foreign Affairs and Trade, “Regional Comprehensive Economic Partnership,” accessed May 24, 2024; Rahul Sen and Amarendu Nandy, “RCEP: A Missed Opportunity for India,” Financial Express, November 8, 2019.

[50] Sunil Mani and Janak Nabar, “Is the Government Justified in Reducing R&D Tax Incentives?,” Economic & Political Weekly, July 23, 2016.

[51] Tanya Jain and Rahul Singh, “How R&D Tax Credits Can Drive Price Competition in Indian Industries,” Ideas for India, February 5, 2024.

[52] Mani and Nabar, “Is the Government Justified.”

[53] Hepeng Jia, “China’s Plan to Recruit Talented Researchers,” Nature 553, no. 7688 (January 17, 2018): S8.

[54] Cong Cao et al., “Returning Scientists and the Emergence of China’s Science System,” Science and Public Policy 47, no. 2 (April 2020): 172–83.

[55] Jitendra Malik and Pankaj Jalote, “Ideate and Innovate: R&D Ecosystem in India Must Be Fixed,” Economic Times, November 16, 2011.

[56] R. A. Mashelkar, Ajay Shah, and Susan Thomas, “Rethinking Innovation Policy in India: Amplifying Spillovers through Contracting-Out” (XKDR Working Paper No. 32, Cross Disciplinary Knowledge Data Research, Bombay, India, March 2024).

[57] R. A. Mashelkar, “Science Led Innovation,” R.A. Mashelkar (blog), accessed May 20, 2024.

[58] Sajeev Chandran, Archna Roy, and Lokesh Jain, “Implications of New Patent Regime on Indian Pharmaceutical Industry: Challenges and Opportunities,” Journal of Intellectual Property Rights 10 (2005): 269–80.

[59] Sajeev Chandran, Archna Roy, and Lokesh Jain, “Implications of New Patent Regime on Indian Pharmaceutical Industry: Challenges and Opportunities,” Journal of Intellectual Property Rights 10 (2005): 269–80.

[60] Department Related Parliamentary Standing Committee on Commerce, Review of the Intellectual Property Rights Regime in India (New Delhi, India: Parliament of India, July 2021).

[61] Sanjeev Sanyal and Aakanksha Arora, “Why India Needs to Urgently Invest in Its Patent Ecosystem?” (EAC-PM Working Paper No. 1–2022, Economic Advisory Council to the PM, New Delhi, India, August 2022).

[62] Under Section 122(2) of the Patents Act of 1970, a person can be punished with six months of imprisonment for furnishing false information.

[63] Under Section 21(1) of the Patent Act of 1970, a patent is deemed abandoned if the applicant fails to meet all imposed requirements.

[64] US Department of Commerce, International Trade Administration, “India—Country Commercial Guide: Protecting Intellectual Property,” last published January 12, 2024.

[65] Sanjeev Sanyal and Aakanksha Arora, “A Boom in Indian Patents: Expanding Manpower in the Patents Office Can Help India Foster Innovation,” Financial Express, November 15, 2023.

[66] Ezell, Assessing India’s Readiness.

[67] In the book When the Chips Are Down, authors Pranay Kotasthane and Abhiram Manchi identify three distinct attempts to build the ecosystem.

[68] Raj Varadarajan et al., Emerging Resilience in the Semiconductor Supply Chain, Boston Consulting Group (May 2024).

[69] Douglas B. Fuller, “Chip Design in China and India: Multinationals, Industry Structure, and Development Outcomes in the Integrated Circuit Industry,” Technological Forecasting and Social Change 81 (January 2014): 1–10.

[70] Ramiro Palma et al., The Growing Challenge of Semiconductor Design Leadership (Washington, DC: Semiconductor Industry Association, November 2022).

[71] Very Large Scale Integration refers to the process used in the design and fabrication of integrated circuits.

[72] Ezell, Assessing India’s Readiness.

[73] The industry benchmark for constructing a 28 nm fab is $1 billion. See, Lucy Rodgers et al., “Inside the Miracle of Modern Chip Manufacturing,” Financial Times, February 28, 2024.

[74] Soumyarendra Barik, “Amid India’s Chip Push, Taiwan Flags Talent Gaps, High Import Tariff,” Indian Express, April 23, 2024.

[75] Kotasthane, “India Watch #2.”

[76] Devesh Kapur and Pratap Bhanu Mehta, “Mortgaging the Future? Indian Higher Education,” India Policy Forum 4, no. 1 (2007): 101–57.

[77] Mashelkar, Shah, and Thomas, “Rethinking Innovation Policy in India.”