India is in a pivotal phase of its development. There is plenty of reason for excitement about its prospects. Its economy has grown by leaps and bounds over the past three decades, to the point that it is poised to become the world’s third-largest economy very soon. Additionally, India is enjoying very favorable demographics, with a median age of around 28 years and a dependency ratio of 32%.[1] This demographic window should last for three more decades. On top of this, ongoing geopolitical rebalancing has raised expectations that India could benefit as multinational corporations reorient their production plans away from China.

Juxtaposed with these positive developmental tailwinds are a few strong headwinds. The obvious challenge is that India is still very poor and agrarian. Its per capita GDP in 2023 dollars is around $2,500, and more than 80% of Indians live at income levels below that. Moreover, over 40% of workers are still employed in the agricultural sector even though that sector accounts for just 15% of GDP.

India’s biggest challenge is rooted, ironically, in its ongoing demographic dynamics. The country is poised to add around 150 million people over the next two decades to its already massive labor force. Finding productive employment for this army of young Indians is the immediate task facing the country’s labor market. Unfortunately, the labor market is coming up short. According to a recent report from the International Labour Organization,[2] the unemployment rate is 18% for Indians with at least a secondary education, and even greater—29%—for college graduates. Even more distressingly, the Centre for Monitoring Indian Economy estimates the unemployment rate of Indians 20–24 years old to be 44%.

These statistics suggest that the key task that awaits policymakers over the next decade is, at the very least, to prioritize transitioning the huge and growing labor force from rural and agrarian work to more urban and nonagrarian work. This transition requires a multidimensional effort that encompasses education policy, labor laws, policies governing land acquisition and commercial rezoning, trade policies, electricity tariff rationalization, urban development, infrastructure development, competition policy, entrepreneurial incubation, and corporate taxation.[3]

Our thesis is that absorbing this army of entrants into the labor market will require the growth of manufacturing firms that are much more labor intensive than the typical Indian firm today. Success will require coordinated policy action on all the dimensions listed above.

Large establishments need land and proximity to townships large enough to supply and house their workers. They also require reliable and quality infrastructure, including power supply, transportation networks, and digital connectivity. They require access to a labor pool with basic literacy and numeracy. Crucially, in order to grow, firms require an enabling regulatory environment—including favorable tax laws and labor laws.

We believe that India’s best bet for creating large, labor-intensive manufacturing firms is to encourage merchandise exports. Plenty of evidence, from both India and other countries, suggests that exporting firms tend to be larger and more efficient than firms that produce only for the domestic market. Moreover, the discipline of international competition means that exporting firms grow in response to market forces rather than nonmarket forces.

If India can export on the basis of its comparative advantage—that is, using relatively low-skilled labor—this will lead to the expansion of labor-intensive manufacturing industries. These expanding industries will draw their labor from the relatively low-productivity agricultural and informal urban sectors. This will constitute a type of growth-enhancing structural change. An additional source of structural change will come from the disciplining force of international trade, which will weed out small and less productive firms. As less productive firms fall victim to international competition, more productive ones will not only survive but grow and, potentially, gain foreign market share. Moreover, economies of scale could further increase their productivity.

Before we expand on our discussion of manufacturing and exports, consider an alternative vision for India. This alternative, articulated by many (but most recently and eloquently by Raghuram Rajan and Rohit Lamba, 2023),[4] centers on the service sector. The idea is that the highest value added in the modern production process is in the pre- and postproduction stages. The value added in these stages comes mostly from business services. India, with its huge labor force, should position itself to grab a slice of global value added in these services.

A service-sector-based development strategy may be neither feasible nor appropriate for India, for two main reasons. First, the skill level of the typical worker is fairly low. This is reflected in recurrent complaints by service-sector firms about the difficulty of staffing their positions because of a lack of candidates with the requisite skills. While business-service jobs admittedly require less skill than many other service-sector jobs, the skills they do require are still much higher than those of the typical worker. Second, the flow of incoming workers is likely plagued by the same skill deficit as the pool of current workers, if the Annual Status of Education Report’s annual education surveys[5] are any indication.

The challenge for policymakers is to find productive employment opportunities for Indian youth today that fulfill the aspirations of these future workers. The service-sector-led model will likely become the appropriate path in a couple of decades if the country dissipates its skill deficit through investments in education. At the moment, though, India needs to entice its workers away from agriculture with productive nonagricultural jobs, and it is most likely to achieve this through export-oriented, large-scale, labor-intensive manufacturing.

The paper begins by discussing India’s current economic situation and why exports matter for employment. It then explores India’s export record compared to that of its competitors in relation to its comparative advantage, worker productivity, and labor endowment. It questions why India’s exports have stalled and analyzes various factors affecting India’s export performance.

The paper identifies the key obstacles hindering India’s export growth, including increasing protectionism and insufficient participation in trade agreements. Subsequently, it delves into the reforms needed across various policy areas, such as trade, labor, land, credit markets, and infrastructure, to create an environment conducive to the growth of large-scale, export-oriented manufacturing. The paper concludes by emphasizing the urgency of implementing these reforms to meet the aspirations of India’s young workforce and to avoid the demographic dividend turning into a demographic curse.

Why Might Exports Matter for Employment?

Many studies show that exporting firms tend to employ more workers and are more productive than firms that produce only for the domestic market. Andrew Bernard et al. (2007) show this systematically for the United States,[6] but similar evidence can be found for other countries. Is it true for India too?

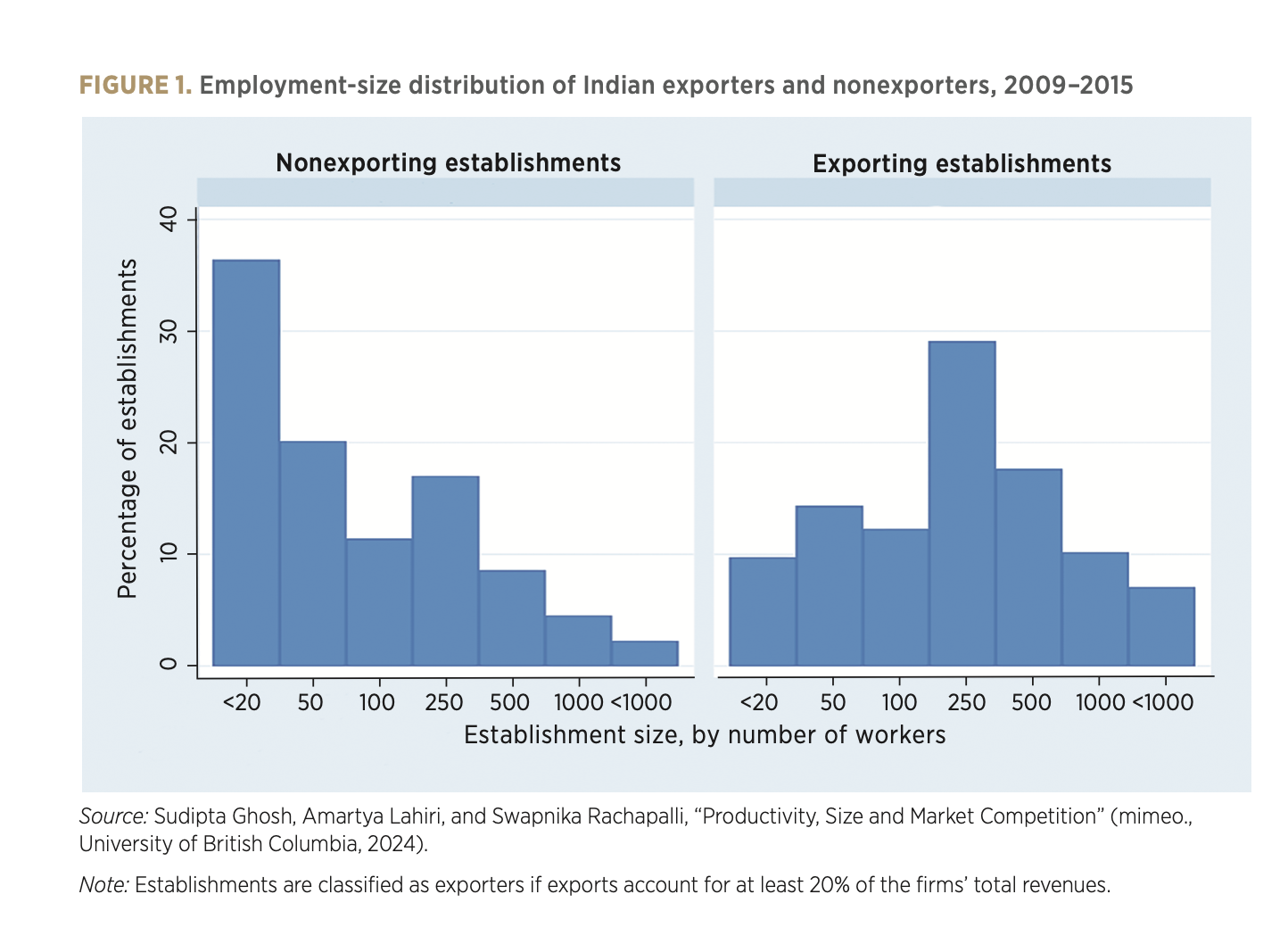

Figure 1 shows the employment-size distribution of nonexporting and exporting establishments in India, included in the Annual Survey of Industries for 2009–15. The left panel shows the employment-size distribution for nonexporting establishments, while the right panel shows the corresponding distribution for exporting firms.

The figure reveals a striking pattern: nonexporting establishments are more likely to employ 50 or fewer workers than exporting establishments are, while exporting establishments are more likely than nonexporting establishments to operate in all size classes above 50. In other words, exporting establishments tend to employ more workers. Research shows that exporting establishments also tend to be more productive across employment-size classes.[7]

These data suggest that incentivizing exports may be one way to induce greater industrial employment. Indeed, exports create jobs through many channels. For instance, they go hand in hand with specialization and with increases in the scale of production, allowing firms to exploit scale economies, if any. And exporters must compete with the best in the world, often in developed-country markets where consumers are more demanding. This pushes firms to become more productive by reducing costs, improving quality, and enhancing managerial efficiency. The resultant increase in profitability creates incentives for firm growth.

In addition to spurring job creation, exports tend to contribute to economic growth. Arvind Panagariya (2019) provides an excellent overview of the international evidence for this effect.[8] And openness to trade and foreign investment significantly contributed to annual growth rates of over 8% in India during the 2003–2012 period and of around 6% during 1988–2003, a considerable improvement over annual growth rates that averaged between 3% and 4.5% during the decades before 1988. This conclusion is supported by micro-level evidence of the positive impact of trade liberalization on firm productivity and firm productivity growth in India after 1991.[9] Economic growth was sustained during 2010–2021: four out of these twelve years saw growth rates of 8% or higher, and eight years saw growth rates of 6% or higher. (Note that the eight years of over 6% growth during this period include the four years of over 8% growth, with remaining years during this period having a growth rate of under 6%.)

India’s Export Record: How Does It Measure Up?

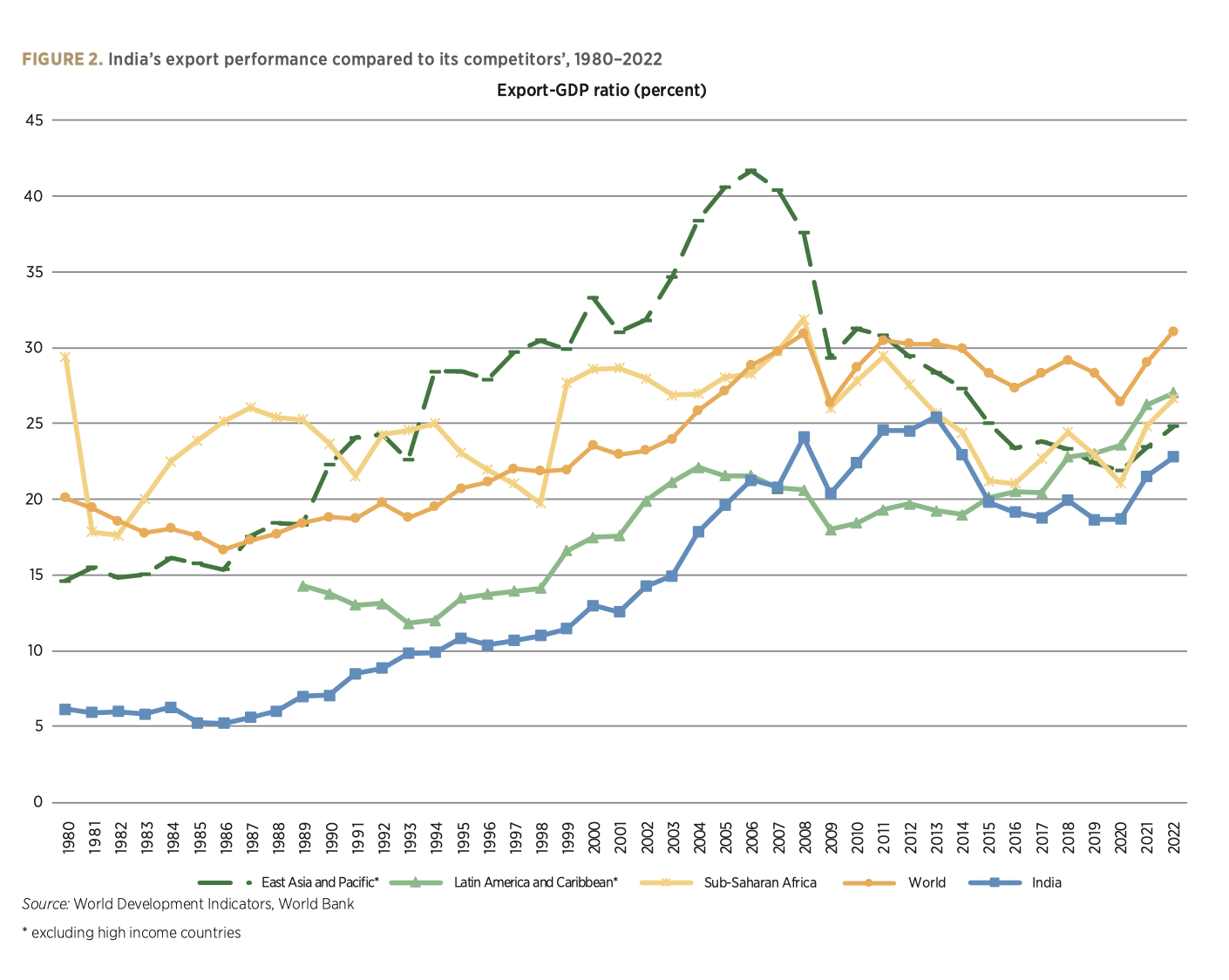

India’s external sector has seriously underperformed over the past four decades. Figure 2 shows the average export-to-GDP ratios in different regions of the world—we exclude high-income countries to focus on India’s competitors. (The figure also shows the export-to-GDP ratios of India and of the world as a whole.) The figure illustrates two key points: (a) except for the brief period from 2007 to 2015, India’s export-to-GDP ratio has consistently been the lowest in the world, and (b) more worryingly, the ratio in 2022 was almost 2 percentage points lower than in 2013. Export performance has stalled for more than a decade. This is in stark contrast to the steady rise (aside from a couple of years) from 6% in 1988 to 25% in 2013.

Note that the patterns in figure 2 mask significant heterogeneity across India’s key competitors in export markets. For example, Vietnam’s export- to-GDP ratio is above 70% and Mexico’s is above 40%, which puts India’s below-25% ratio in stark relief.

Even if we avoid comparisons with Asian powerhouses such as South Korea and China, India has underperformed relative to countries such as Indonesia, Thailand, Malaysia, and Vietnam. Given the evidence about the positive effects of exports on employment and growth, it’s imperative that we uncover the reasons for the tepid performance of India’s export sector and find ways to improve this performance.

The Basis of Trade: Comparative Advantage

Country A is able to export a product to country B if A’s per-unit production and trading costs for the product are lower than the corresponding costs for any substitutes that B could buy from another country. If the product is labor intensive, then a major portion of these costs is the labor cost.

Per-unit labor costs depend on wages and labor productivity. While a developing country like India might have lower labor productivity in every area of production than an advanced country like the United States, India’s productivity disadvantage in certain labor-intensive industries—such as textiles, apparel, and footwear—can be more than offset by its wage advantage, making it advantageous for developed-country consumers to buy these products from India. This is the principle of comparative advantage, which forms the basis of much of international trade.

Comparative advantage depends on several factors, two of which are key. The first is a country’s endowments, and the second is its productivity. These determinants were first emphasized in the Heckscher-Ohlin and Ricardian models of comparative-advantage-driven trade; they were later elaborated on in Dornbusch-Fischer-Samuelson models of a continuum of goods and (more recently) in the well-known Eaton-Kortum model within a many-goods, many-countries framework with trade costs. Productivity-driven trade is also emphasized in the newer, heterogeneous-firm-based Melitz models of intra-industry trade. How does India stack up against its competitors in endowments and productivity?

The Productivity of Indian Workers

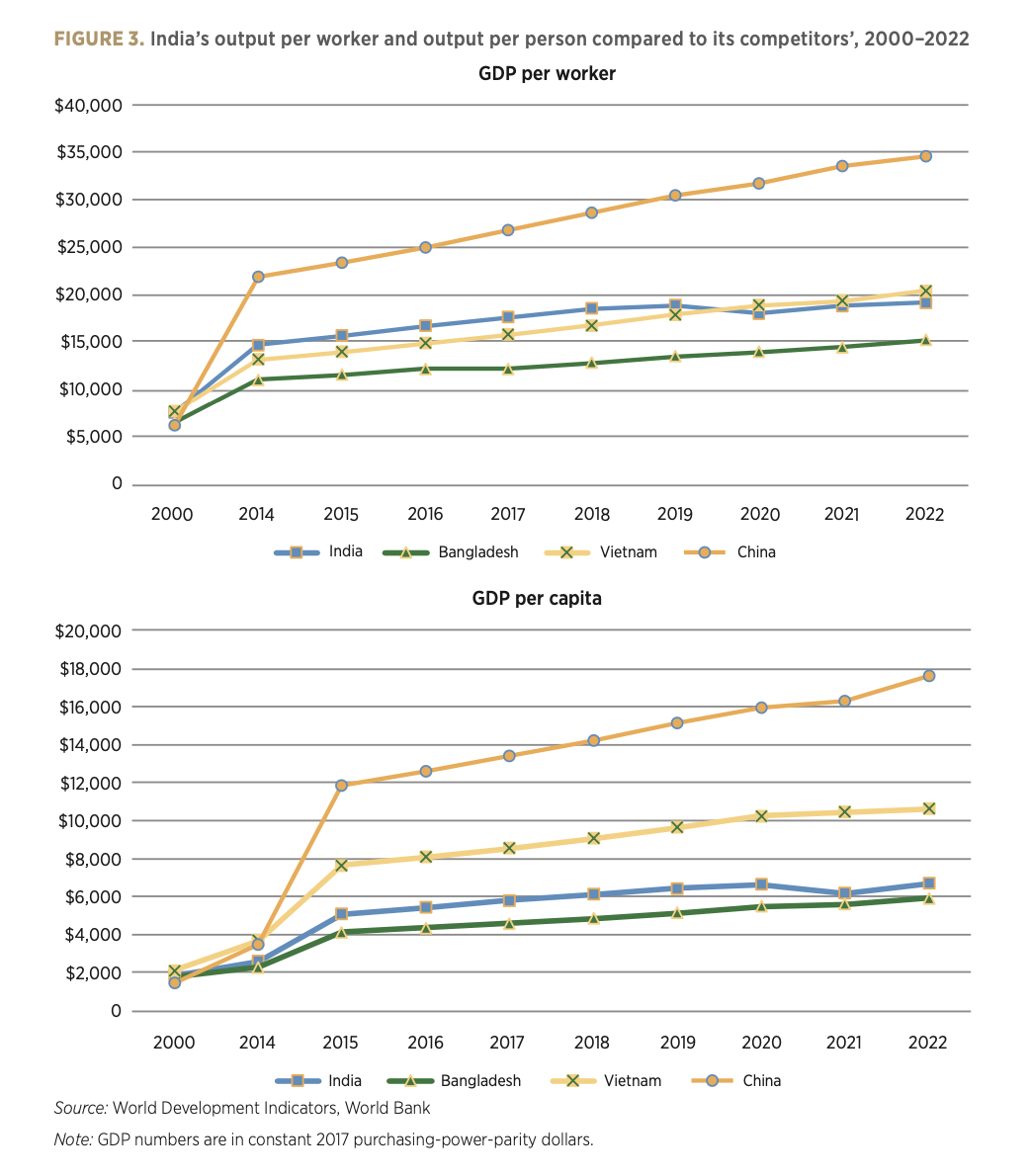

India’s ability to compete ultimately depends on the productivity of its workers and how their productivity compares with the productivity of workers in competing countries. While sectoral productivity is the relevant variable to focus on here, it is useful to start with a cross-country comparison of overall productivity among India’s competitors in labor-intensive exports. Figure 3 shows GDP per worker and GDP per person (in constant purchasing-power-parity dollars) in China, Bangladesh, India, and Vietnam since 2000.

A few facts leap out. First, all four countries had remarkably similar GDP per worker and per person in 2000. China has clearly separated itself from the other three nations since then. Second, regarding per capita GDP, Vietnam has done much better than India and Bangladesh since 2000. This is well recognized, to the point that Vietnam is often cited as the latest example of export-led growth. Third, the panel on labor productivity (GDP per worker) reveals that Indian labor productivity is roughly the same as Vietnamese productivity and is greater than Bangladeshi productivity. Thus, Indian workers can definitely compete with Vietnamese and Bangladeshi workers.

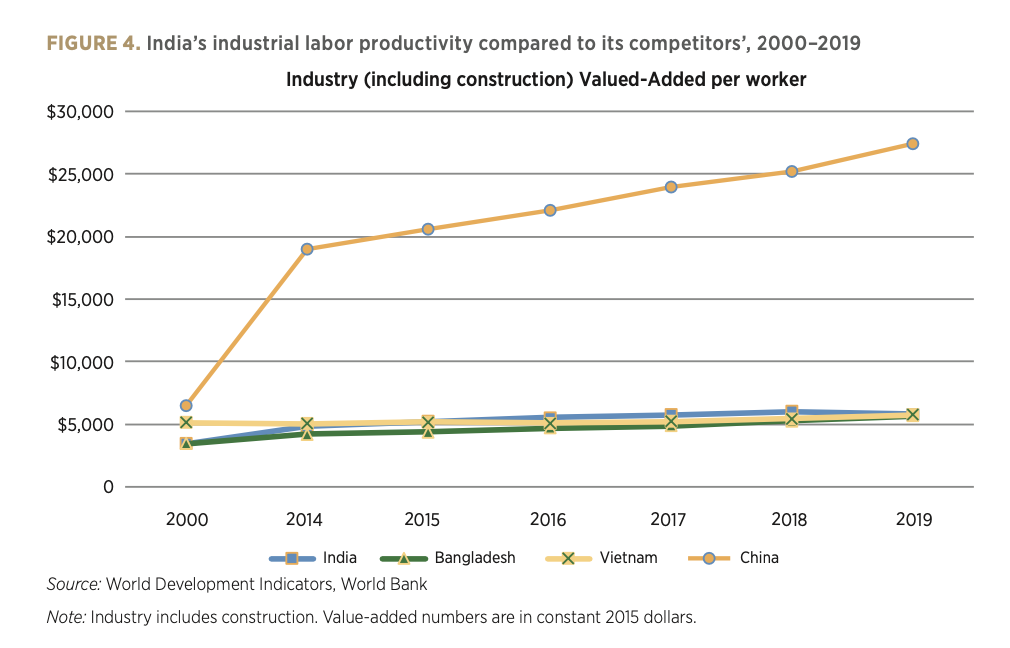

One could argue that the sectoral composition of output is very different in these countries. The productivity of Indian labor might be much lower in manufacturing but higher in services compared to the productivity of Vietnamese workers. If this is the case, then India will find it hard to compete with Vietnam in manufacturing-goods exports. Thus, figure 4 compares the labor productivity of workers in industry (including construction) in the same four countries. Even in industry, labor productivity in India is the same as labor productivity in Vietnam, despite the average Indian worker’s lower level of education and skills.

India’s Labor Endowment

As we noted in the introduction, India is in the middle of a golden demographic phase. Its median age is 28 years, 26% of its population is under the age of 15, and just 6% of its population is 65 or older. The upshot is that India has a very young workforce, has a dependency ratio of just 32%, and is adding around 10 million workers to its labor force annually. This confluence of factors is often referred to as India’s demographic dividend.

By comparison, the median age in China is 38 years. While China’s dependency ratio of 31% is comparable to India’s, its composition is different, since 14% of Chinese dependents are 65 or older. Further, China’s dependency ratio and its composition are projected to worsen sharply over the next three decades.

Vietnam’s position is somewhere between China’s and India’s. Vietnam’s median age of 32 is somewhat higher than India’s and it has a slightly larger share of older dependents, but its overall dependency ratio is also 32%.

While the ongoing increase in the supply of young Indian workers is good news, their skill level is generally inadequate. The government’s 2015 National Policy for Skill Development and Entrepreneurship report estimated that only 5% of the Indian workforce had formal skill training.[10] A 2022 UN report on skilling, entrepreneurship, and job creation in India states that the fraction of the workforce with formal skilling may be even lower: 2%.[11] Clearly, this is a workforce that is best classified as young and relatively low skilled.

Of the 10 million Indian workers joining the labor market every year, about 80% have secondary school education or higher levels of educational attainment.[12] However, the quality of their education is poor. The Annual Status of Education Report highlights this problem by documenting massive deficiencies in the reading and numeracy skills of Indian schoolchildren.[13] The skills problem also shows up among those with college degrees or even higher degrees. India graduates around 2.5 million STEM students annually. However, firms employing a lot of high-skill labor routinely complain that a large fraction of these graduates are not adequately skilled.

In summary, India is a poor country with a large workforce that is young, growing fast, and relatively low skilled. Over 80% of workers are in low-productivity, informal employment, and a huge proportion are still employed in agriculture. Consequently, India’s comparative advantage is in low-skilled, labor-intensive products.

Why Have Indian Exports Stalled?

The preceding discussion raises a key question: What is holding back India’s export sector? The answer is public policy. Over the past decade, India’s trade policy has become more protectionist. The average most-favored-nation applied tariff on nonagricultural products rose from 10% in 2015 to 15% in 2021.[14] According to Arvind Panagariya (2021), the simple average of tariffs rose from 8.9% in FY 2010/11 to 11.1% in FY 2020/21.[15] While 11.9% of tariff lines had tariff rates above 15% in 2010/11, the proportion rose to 25.4% in 2020/21. Clearly, trade reforms achieved over almost a quarter of a century are being slowly reversed.

The underlying problem is that mercantilist policy, which pursues export expansion and import restriction at the same time, is not feasible. This is a clear corollary of the Lerner symmetry theorem, which states the equivalence between an x% tax on exports and an x% import tariff. The simplest explanation of the theorem starts by recognizing that desired import purchases are a key reason to export. People use the foreign exchange generated from exports to import products. Thus, import substitution renders exports useless.

A second explanation is that the demand for foreign exchange is reduced by restricting imports. This reduces the price of foreign currencies in terms of the domestic currency—that is, the domestic currency appreciates. This makes exports more expensive abroad, thereby reducing their volume.

A third explanation is that import substitution moves resources into the production of import-competing products, so fewer resources are left for the production of exportable goods. Import substitution also makes importable products more expensive, so consumption shifts toward exportables (the substitution effect), and fewer of these products are left for exportation. Thus, increasing import protection is not consistent with increasing exports.

Another explanation is that many exports need intermediate inputs that have to be imported. Tariffs on imported inputs work against the competitiveness of these exports. For example, India struggles to export synthetic-fabric garments primarily because of the industry’s high input costs owing to the country’s high tariffs (about 20%–25%) on synthetic fibers and fabrics.

Finally, high final-goods tariffs can hurt export competitiveness. For example, high tariffs on automobiles (in the range of 60%–125%) have made the Indian automobile industry inefficient and uncompetitive. Given that the assembly of cars is labor intensive, the tariffs potentially hurt automobile exports that could create quality jobs.

As a highly populous country with low levels of education, India has an abundant supply of low-skilled labor. Clearly, India’s factor-based comparative advantage is in the production of labor-intensive products requiring low-skilled labor. Yet these are among the products India has been importing. Its inability to compete on the world market for these products is evidenced by the doubling of its tariffs on entry-level, labor-intensive products such as beauty aids, watches, toys, furniture, footwear, kites, and candles in 2017 and 2018. Import duties on electronics (for example, mobile phones, TVs, and their inputs and parts) also saw steep hikes. Furthermore, import duties on electronics and automobile components, fabrics, and agricultural products rose in 2020 and 2021. Thus, India’s trade policy has been working against its labor-intensive input processing and assembly.

The implication is that tariffs should not be raised further. Instead, they need to be lowered beyond 2014 levels. Tariffs especially need to be reduced on imports of inputs. For example, reducing import tariffs on synthetic yarn and fibers would provide a big boost to Indian apparel exports. High output tariffs are also harmful, because they breed inefficiency.

Richard Baldwin’s idea of the smile curve makes it tempting to keep entire value chains within national boundaries. The idea is that the highest-value-added tasks are at the front and back ends of the production process, while the stages in the middle have the lowest value added. The middle stages are where the actual production, including assembly, takes place. At the front end is the development of the idea and design of the product, while the back end includes marketing and sales. But production fragmentation and offshoring are the modern way of production. As a result, developing countries are able to perform a larger range of labor-intensive tasks, including those involved in producing goods that are capital intensive overall. This creates opportunities to combine developing-country labor with advanced-country technology to create better jobs that pay higher wages.

Along the global value chain, each task within a production process is performed where it is cheapest. A labor-abundant country with cheap labor is thus likely to perform the labor-intensive tasks of a global supply chain. For this reason, India’s Phased Manufacturing Programme, designed to encourage all activities (including high-value-added ones) in value chains to take place entirely within India, is unlikely to encourage the production of exportables. These goods are not going to be able to compete with goods whose components are all produced in the lowest-cost way as part of a global value chain. Even in the domestic market, goods produced under the Phased Manufacturing Programme will be competitive only with the assistance of final-product import protection or production subsidies.

Considering data from 112 sectors during 1999–2013, C. Veeramani and Garima Dhir (2022) find that using imported inputs and producing as part of a global value chain leads to higher levels of gross exports, domestic value added, and employment than when the value chain is kept fully indigenous.[16] Specializing in just a few tasks with low value added per unit can lead to higher total value added than performing all tasks. The higher volume of exports offsets the low value added per unit.

Tariff inversion is another crucial deleterious feature of the Indian import-tariff schedule. It refers to the situation in which the tariffs on imports of inputs into an industry are higher than the tariffs on imports that compete with the output of that industry. The higher the ratio of input to output tariffs, the greater the inversion. C. Veeramani and Anwesha Basu (2021) find inversion in India to be quite high in what The Economic Survey of 2020 calls network products (for example, electrical machinery, electronic equipment, road vehicles, office machinery, and telecommunications equipment).[17] Ironically, these are precisely the products that embody the modern global-value-chain structure: they have the most internationally fragmented production processes to minimize their production cost. The Economic Survey of 2020 strongly recommends linking into the global value chains of these products to generate export expansion and growth.[18] Tariffs paid on inputs imported for export production are supposed to be reimbursed, but the reimbursement process is very complicated and slow. The result is an obstruction to working capital. This problem is magnified for foreign firms that cannot navigate the Indian regulatory bureaucracy. At the very least, tariff inversion handicaps both foreign and domestic firms producing for India’s large domestic market.

Tariff inversion, therefore, needs to be reversed—and it began to be reversed in India’s 2022 and 2023 budgets. Veeramani and Basu have found that India’s share in world exports of network products is 0.5%, compared to China’s 17.5%.[19] This might seem disappointing, but the silver lining is that it should not be difficult for India to double or triple its share.

Another possible reason for India’s stagnant exports is its inability to negotiate free trade agreements (FTAs). India’s competitors, such as Vietnam, are part of important trade agreements such as the US-Vietnam Bilateral Trade Agreement. Thus, India is handicapped in many important markets, including the two big ones: the United States and the European Union.

India’s withdrawal from Regional Comprehensive Economic Partnership was disappointing. India has started signing FTAs, but it has a long way to go. Recently, it signed an FTA with the United Arab Emirates and another with Australia. Even though Australia’s population is small at 28 million, its per capita income, which is several folds higher than India’s means it represents a fairly large market for India’s exports. Also, this FTA requires India to fully remove tariffs on imports of cotton and aluminum from Australia, both of which are important inputs in final manufacturing. This agreement illustrates the benefits that could come from negotiating FTAs with larger markets such as the European Union, the United States, and the United Kingdom.

Successfully competing with producers from Vietnam and China, both of which have FTAs with Australia, will not be easy. These countries have higher average education levels, better infrastructure, and more flexible labor markets than India, which puts pressure on Indian policymakers to carry out further domestic reforms, especially those relating to factor markets.

With the multilateral system under the World Trade Organization in total disarray, negotiating FTAs is the only way for India to open up markets for its manufacturers. Indian trade negotiators have to realize that trade concessions have to be exchanged, and no country is doing another country a favor in these negotiations. India has been far behind the curve in this realm.

Are Other Factors Affecting India’s Export Performance?

India’s labor-intensive industries are primarily filled with small firms. Since these firms cannot exploit any economies of scale, they are not internationally competitive. Even though reservations for small-scale firms in labor-intensive industries are long gone, small firm size persists in these industries. This can happen in the presence of external economies, in which any firm’s productivity is a positive function of industry output (the aggregate of all firm outputs in that industry), which the firm takes as given. This can lead to multiple equilibria, and India’s labor-intensive manufacturing industries (and their firms) may be stuck in a bad equilibrium: small in size and low in productivity.

The policy solution to this problem, as to any problem with positive externalities, is subsidies for the activity under consideration—in this case, subsidies to expand capacity in such industries, whether for domestic investment or for foreign direct investment. Raghuram Rajan and Rohit Lamba’s criticism of subsidies for foreign direct investment is twofold: such subsidies bring in only the low-value-added assembly production stage, and there is no reason for foreign capital to stay once the subsidies have ended.[20] We saw from the work of C. Veeramani and Garima Dhir that the first criticism is misplaced: the volume effect dominates the value-added-per-unit effect.[21] The second criticism also has problems. Foreign investors have incurred sunk costs, so there is a good chance that their capital will not leave. Hopefully, once the foreign capital comes in, foreign companies will get positive information about the skills of Indian workers, at least in some areas.

The other way to solve the problem of multiple equilibriums arising from positive externalities is to encourage clusters: special economic zones (SEZs) or autonomous economic zones (AEZs).[22] We are not talking about the average Indian SEZ, which is 0.3 square kilometers. India has 250 SEZs, most of which are extremely small. These are much smaller than Chinese SEZs such as Shenzhen, which is 1,950 square kilometers. By Indian standards, a very large SEZ is Mundra in Gujarat, which is 396 square kilometers.

Arvind Panagariya, Priyaranjan Jha, and one of us (Devashish Mitra) (2020), argue in favor of setting up five or six AEZs of around 500 square kilometers each (i.e., slightly bigger than Mundra), each with an autonomous administration.[23] The AEZs would be on currently inhabited land and would offer more relaxed labor regulations and higher maximum floor space indexes (FSIs) than non-AEZ areas of the country. While we argue that labor regulations should be relaxed all over the country (not just in AEZs), given the political obstacles we anticipate, we advocate introducing considerably relaxed labor regulations in AEZs first. The success of AEZs might have a demonstration effect on the rest of the country.

Each AEZ would act as a coordinating device for agglomerating related economic activities through labor market pooling, for locating related input suppliers, and for easing capital constraints through public-private partnerships and foreign direct investment (which would find these AEZs attractive). The need to build new amenities and infrastructure would provide jobs in construction right away.

One success story of a cluster in India is the automobile production and automotive parts cluster in the Chennai area. Factories in this area produce auto parts for many car models and makes from all over the world, and many international models and makes of cars are assembled there. This cluster is about 60 kilometers long and represents about 30%–35% of India’s total auto and auto-parts production.[24] More such clusters and AEZs are needed.

The scale of labor-intensive manufacturing in India may also have been restricted because of labor regulations that apply only to firms above a threshold employment size. Firms above this threshold are not allowed to fire workers without government permission, which has rarely been granted. There are also severe restrictions on firms’ ability to reassign workers to a different task. Thus, firms cannot agilely adjust their employment in response to demand and technology shocks. The firing restrictions effectively become hiring restrictions. Companies can avoid these rules by remaining small or by opting for more capital-intensive methods of production. These evasions give firms greater flexibility, but at a cost: they forgo scale economies and can’t utilize India’s comparative advantage.

Labor reforms have made some progress over the last decade. As mentioned earlier, complicated labor laws have been consolidated into four labor codes to eliminate duplication and inconsistencies. The Industrial Disputes Act threshold (above which a firm must seek government permission to fire workers) was raised from 100 to 300 workers in Maharashtra, Rajasthan, and Uttarakhand, and later also in the national Industrial Relations Code, one of the four new labor codes that consolidate numerous complicated labor laws. The union membership threshold has also been raised from 10% to 30% in Rajasthan and then to 51% in the Industrial Relations Code. To minimize harassment by inspectors, the government has set up a unified central web portal where firms will report their compliance with labor regulations. Algorithms will automatically detect inconsistencies that could trigger inspections. The government has introduced fixed-term labor contracts that allow firms to hire workers for a couple of years rather than indefinitely; these contracts provide some flexibility to firms seeking to adjust their labor input.

While all these changes are desirable, the implementation of the four codes needs to be accelerated. The delay in their implementation leaves India handicapped in the competition for external markets. The new threshold of 300 workers for the Industrial Disputes Act is much better than the old threshold, but much bigger firms are needed if India is going to compete with China and other Asian countries. The threshold needs to be quickly raised at least to 1,000 workers. The reassignment of workers to new tasks should be allowed so that firms can respond flexibly to various technology and demand shocks.

Regarding land acquisition, there are serious political-economy constraints obstructing the reform of land-acquisition regulations. Before firms can operate at a large scale, employing many workers, they must acquire several contiguous pieces of land from different owners. The laws regarding such acquisitions are very complicated, and the requirements are often impossible to meet. Besides, Indian city laws restrict the maximum FSI by constraining the vertical expansion of buildings (including manufacturing firms’ buildings). The easiest course of action is to follow more advanced countries’ best practices regarding FSIs. The maximum FSIs are currently much lower in Indian cities than in cities in the United States and Europe. The problem of how to spur land-acquisition reforms is a complicated political-economy question; increasing FSIs, on the other hand, is low-hanging fruit.

India also faces problems related to infrastructure and credit market imperfections. Infrastructure is a public good that is also an input into production. It includes roads, ports, railway lines, internet connectivity (through the laying of fiber-optic cables), and assured power supply. Because of the free-rider problem (positive externalities) associated with infrastructure, private provision is not possible. The government, therefore, has an important role to play, at the very least in coordinating private actors. Not only has India lagged far behind China in infrastructure, it also seems to be behind many other Asian countries, such as Vietnam, Thailand, and Indonesia. India’s poor infrastructure raises production costs in manufacturing and makes India’s exports uncompetitive. While infrastructure figures among the major achievements of the current government, far more needs to be done.

Railways are the only category of infrastructure in which the current government has not made satisfactory progress. In about a decade, India has almost doubled its national highway system, which expanded from 91,000 kilometers in 2014 to 175,000 kilometers in 2023. It has doubled its airports during the same period: the number of functional airports increased from 74 to 148. Between 2019 and 2023, it increased port capacity by 70%, from 1,534 metric tons per annum to 2,600 tons. In addition, 208,000 of the 250,000 panchayats (village councils) in India have been connected by a high-speed fiber-optic network. The total laid length of fiber optics increased from 1.06 million kilometers to 3.90 million kilometers.[25] These are certainly steps in the right direction—the importance of infrastructure cannot be overemphasized. Here again, much remains to be done.

India’s use of public-private partnerships is sensible because it relaxes the government’s revenue constraint: private companies might get paid through the toll they collect over long periods, or they might view their expenditure on infrastructure as an investment that earns them an annual return from the government. In addition, the private sector is expected to be more efficient than the public sector, offering shorter completion times. Private firms also have incentives to provide higher-quality infrastructure to avoid the cost of repairs later. These incentives do not apply in the public sector.[26]

Regarding credit market imperfections, small enterprises often find it difficult to obtain credit. Credit is obtained by providing collateral, and collateral is difficult for many enterprises to find. The ability to provide the required collateral is not correlated with an entrepreneur’s competence and ability. India’s credit market needs a framework or setup for carefully evaluating credit applications and collecting local information. It needs trained evaluators.

In the absence of such a setup, many businesses that could potentially expand are unable to do so. Often businesses seek an investment subsidy as an alternative to obtaining credit, but such subsidies are wasteful expenditures if they are provided to the wrong firms. One of the main financial achievements of the current government is the Insolvency and Bankruptcy Code, 2016, which specifies how unproductive businesses can be restructured, if possible, and how totally unviable businesses can be dissolved. This absorbs some of the risks of failure in business expansion.[27]

All these factors demonstrate that boosting India’s performance in the export of labor-intensive manufactures requires a multipronged strategy. Reforms are needed in the markets for labor, land, and capital. Labor regulations need to be reformed, especially those concerning firing workers and reassigning tasks. Regarding land, the maximum allowed FSI must be raised. Over time, significant reforms in land-acquisition laws must also be undertaken. Regarding capital and credit, the Insolvency and Bankruptcy Code has been a major step in the right direction. However, the country also needs a way to carefully evaluate credit applications and collect local information so that potentially successful business projects will get a chance and potential failures can be weeded out at the application stage.

Conclusion

India stands at a pivotal juncture in its economic history. While it has acquired some economic and political heft in global affairs on account of its large economy, it must rapidly raise the economic fortunes of the average Indian. Its current demographic situation makes this necessary. It is crucial that the country find productive employment for its young and rapidly expanding labor force in a way that fulfills the aspirations of these new workers.

The most promising way forward is to incentivize entrepreneurs to invest in large-scale, labor-intensive manufacturing with a focus on exports. The experience of other countries at similar stages of development suggests that this is the fastest way to move relatively low-skilled workers out of agriculture and into more productive and higher-wage nonagricultural employment. This strategy is feasible because Indian workers, despite their lower education levels, are as productive as many of their counterparts in competitor countries.

Achieving the transition to an economy friendly to large-scale, export-oriented manufacturing will require an array of integrated reforms to the regulatory framework overseeing trade, land acquisition, labor relations, business compliance, and finance. It will also require investments in education and infrastructure and reforms in urban development and tax policy. This is a big ask. But there is scarcely time to lose. The decisions made by the next government could turbocharge the country to reach economic superpower status. Failing to fulfill the aspirations of young Indians, on the other hand, risks converting the ongoing demographic dividend into a demographic curse.

Notes

[1] The median age data are from “World Population Prospects 2024,” United Nations, https://population.un.org/wpp/. The data on dependency ratio are based on the data on percent of total population in the 15–64 years age category from “World Development Indicators,” World Bank, https://datatop-ics.worldbank.org/world-development-indicators. Our definition of the dependency ratio is the percent of total population not in the 15–64 years age category.

[2] International Labour Organization and Institute for Human Development Joint Publication, India Employment Report 2024.

[3] Many of the other papers in this series will address facets of this effort. For further discussion of labor laws, see Shruti Rajagopalan and Kadambari Shah, “How India Labor Law Prevents Firms from Scaling” (Mercatus Policy Research, Mercatus Center at George Mason University, Arlington, VA, August 2024). For discussion of trade policies, see Arvind Panagariya, “India’s Trade Policy and a Roadmap for Its Liberalization” (Mercatus Policy Research, Mercatus Center at George Mason University, Arlington, VA, July 2024) and Pravin Krishna “India: Trade Agreements as Trade Strategy?” (Mercatus Policy Research, Mercatus Center at George Mason University, Arlington, VA, July 2024). For discussion of electricity tariff rationalization, see Ankita Dinkar and Samrudha Surana, “Powering Progress: Resolving Electricity Challenges in Indian Manufacturing” (Mercatus Policy Research, Mercatus Center at George Mason University, Arlington, VA, August 2024). For discussion of competition policy, see Shreyas Narla, “Anti-big, Anti-global? India’s Competition Law and Policy for Dominant Enterprises” (Mercatus Policy Research, Mercatus Center at George Mason University, Arlington, VA, July 2024). For a discussion on advanced manufacturing and innovation, see Pranay Kotasthane and Sarthak Pradhan, “India’s Climb up the Innovation Ladder: Policy Enablers and Impediments” (Mercatus Policy Research, Mercatus Center at George Mason University, Arlington, VA, July 2024).

[4] Raghuram G. Rajan and Rohit Lamba, Breaking the Mould: Reimagining India’s Economic Future (Penguin Random House India, 2023).

[5] ASER Centre, Annual Status of Education Report 2023, Beyond Basics (New Delhi, January 2024).

[6] Andrew Bernard et al., “Firms in International Trade,” Journal of Economic Perspectives 21, no. 3 (2007): 105–30.

[7] Sudipta Ghosh, Amartya Lahiri, and Swapnika Rachapalli, “Productivity, Size and Market Competition” (mimeo., University of British Columbia, 2024).

[8] Arvind Panagariya, Free Trade and Prosperity (New York: Oxford University Press, 2019).

[9] Pravin Krishna and Devashish Mitra, “Trade Liberalization, Market Discipline and Productivity Growth: New Evidence from India,” Journal of Development Economics 56, no. 2 (1998): 447–62; Petia Topalova and Amit Khandelwal, “Trade Liberalization and Firm Productivity: The Case of India,” Review of Economics & Statistics 93, no. 3 (2011): 995–1009.

[10] Ministry of Skill Development and Entrepreneurship, National Policy for Skill Development and Entrepreneurship 2015 (New Delhi: Government of India).

[11] United Nations India, “Skilling, Entrepreneurship, and Job Creation,” December 31, 2022, https://india.un.org/en/172091-skilling-entrepreneurship-and-job-creati….

[12] Ministry of Finance, The Economic Survey 2022 (New Delhi: Government of India).

[13] ASER Centre, Annual Status of Education Report 2023.

[14] Rajeshwari Sengupta, “Budget 2023–24: Fiscally Conservative but Lacking Economic Strategy,” Ideas for India, February 27, 2023.

[15] Arvind Panagariya, “India’s Trade Policy: The Past, Present and Future” (36th Exim Bank Commencement Day Annual Lecture, Exim Bank, India, 2021).

[16] Choorikkad Veeramani and Garima Dhir, “Do Developing Countries Gain by Participating in Global Value Chains? Evidence from India,” Review of World Economics 158, no. 4 (2022): 1011–42.

[17] Choorikkad Veeramani and Anwesha Basu, “Fix Inverted Tariff Structures to Boost Industrial Growth in India,” Mint, January 27, 2021; Ministry of Finance, The Economic Survey 2020 (New Delhi: Government of India).

[18] Ministry of Finance, The Economic Survey 2020.

[19] Veeramani and Basu, “Fix Inverted Tariff Structures to Boost Industrial Growth in India.”

[20] Rajan and Lamba, Breaking the Mould.

[21] Veeramani and Dhir, “Do Developing Countries Gain?”

[22] Special economic zones are large areas within a country set apart to promote free trade, to create special incentives for foreign direct investment, or to promote technology development. Incentives might include more relaxed industrial, labor, and tax regulations. Direct tax concessions and subsidies might also be provided. Since the governments within these zones might be somewhat autonomous in relation to the national or state government, SEZs are also sometimes called autonomous economic zones.

[23] Arvind Panagariya, New India: Reclaiming the Lost Glory (New York: Oxford University Press, 2020); Priyaranjan Jha and Devashish Mitra, “How a Successful ‘AEZ Model’ Can Remove India’s Structural Bottlenecks,” Economic Times, May 19, 2020.

[24] “Tamil Nadu: The Hub of Auto Component Manufacturing,” Industry Outlook, n.d., accessed July 2024.

[25] For details on the progress in infrastructure development, see Arunabh Saikia, “A Decade under Modi: Faster Highways, Struggling Railways, Building More Airports,” Scroll, February 5, 2024.

[26] For a useful discussion of private versus public sector in infrastructure building, see Vijay Joshi, India’s Long Road: The Search for Prosperity (New York: Oxford University Press, 2017).

[27] Joshi offers a useful discussion of credit market imperfections and the Insolvency and Bankruptcy Code (with applications to India) in Joshi, India’s Long Road.