This paper is devoted principally to identifying the major import barriers in India and suggesting a road map for trade policy reform. It begins with a general discussion of the potential sources of gains from free trade. It then provides a brief history of trade policy in India. It goes on to summarize India’s current trade policy and discuss the importance of trade liberalization today. The paper then outlines a road map for trade liberalization in the coming years and offers some concluding remarks.

The Conventional Case for Free Trade

Free trade can generate benefits and contribute to growth and development in at least five ways.[1] The first is gains from international specialization and exchange, as emphasized by the Ricardian principle of comparative advantage and the Heckscher-Ohlin theory. Freeing up trade leads a country to expand and specialize in products for which its production costs in terms of output forgone of other products are lower than the price it receives for them in terms of the latter in the world market. Simultaneously, it leads the country to cut its production of products for which its costs in terms of the products whose output it expands is higher than the price it pays for them in terms of the latter in the world market. Thus, free trade leads the country to specialize in products whose real (that is, opportunity) costs are lower than their prices in the world market and to despecialize in products whose real costs are higher than their prices in the world market. It then exports the products whose production expands in return for products whose production it contracts. This brings gains from efficient specialization and exchange.

Second, when production is subject to economies of scale, trade allows each country to specialize in a handful of products. This allows each country to lower the costs of production of products it continues to produce by taking advantage of scale economies. It can then sell a part of the output of the products it continues to produce in exchange for those it ceases to produce. This is the source of gain associated with new trade theory, for which economist Paul Krugman was awarded the Nobel Memorial Prize in Economic Sciences in 2008.

Third, trade serves as a vehicle for the diffusion of the most productive technology worldwide. This diffusion may take place through at least two channels: technology may be embodied in machines that can be imported, and it may be embodied in imported products and accessed through reverse engineering. Since new technologies are developed continuously by different countries, trading freely is the best way to access them.

Fourth, engaging in the global economy subjects a country to competition against the best in the world. Such intense competition keeps entrepreneurs on their toes and offers an opportunity to learn from the best. This is not unlike the game of cricket, in which international competition in test matches and T20 International games has helped India produce more and more world-class players.

Finally, free trade benchmarks the economy against the best in the world. If the country is then unable to compete effectively in the world markets, it is a sign that its domestic policies, regulations, and infrastructure require tweaking. Exposure to the best in the world is an effective instrument for throwing light on domestic policy distortions and poor infrastructure. In contrast, protection hides these weaknesses.

The Postindependence History of India’s Trade Policy

India’s first prime minister, Jawaharlal Nehru, saw an intimate link between imperialism and international trade. He reasoned that the factories in the colonizing country needed sources of raw materials and markets for their finished products. Their colonies were the means to both. That reasoning led him to adopt self-sufficiency—no or minimal reliance on international trade—as a primary objective of his development effort. Accordingly, he sought to realign India’s production with its consumption needs through investment licensing and import control.

India inherited the import control machinery from the Second World War when the colonial government first introduced import licensing and exchange control with essentiality and domestic non-availability as preconditions for imports. Over time, as the rupee became progressively overvalued—because of its fixed nominal value in terms of the British pound and the higher inflation rate at home than abroad—export revenues shrank and the import-control regime became tighter and tighter. By the early 1960s, imports of consumer goods other than essential items, such as food, had been fully banned, and imports of intermediate inputs and capital goods were subject to strict licensing.

A slight improvement in the foreign exchange availability due to a depreciation of the rupee following the breakdown of the fixed exchange rate system and the appearance of remittances from the Middle East in the wake of the oil crisis led to a marginal relaxation of import controls in the second half of the 1970s. This process accelerated in the 1980s, especially in the second half. The government expanded the scope of imports not subject to import licensing and introduced several export incentives to counter the anti-export bias due to import controls. This liberalization was also made possible by a temporary improvement in the availability of foreign exchange, a result of depreciation of the rupee, the elimination of food imports due to the Green Revolution, and a reduction in oil imports following the discovery of oil in the Bombay High Field.

Rising import needs of an expanding economy, a rapidly increasing share of debt service payments in export earnings due to external debt accumulation to finance persistent and large fiscal deficits, partial import liberalization, limited expansion of exports, and a spike in the oil price following the United States invasion of Iraq led to a balance-of-payments crisis in 1991. The government then wisely took advantage of the crisis to launch major economic reforms, including trade liberalization. It devalued the rupee by 18.3% and withdrew import licensing for raw materials, intermediate inputs, and capital goods. However, import licensing for consumer goods ended only in 2001 following a ruling by the World Trade Organization (WTO).

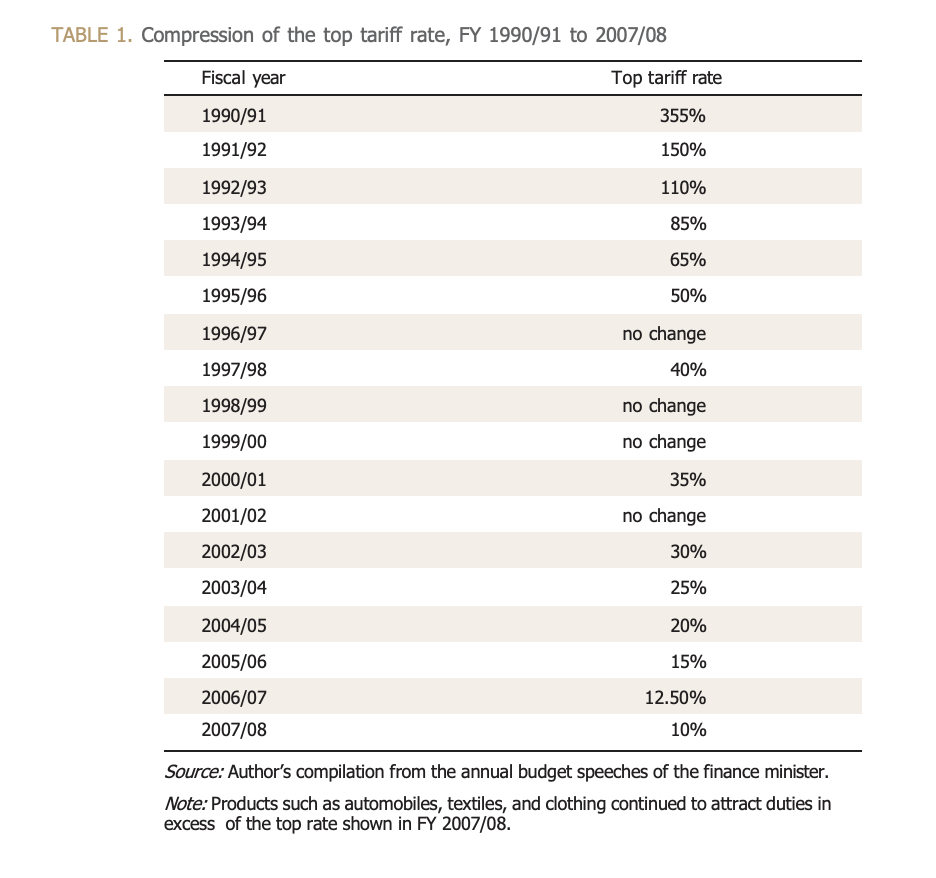

Import licensing was only the top layer of restrictions on imports in India. Pre-1991, the country also had tariffs sufficiently high to rule out any meaningful liberalization of imports. Therefore, the second step of liberalization was a reduction in tariffs, which was sustained until FY 2007/08.[2] The principal approach was to reduce tariffs at the top. Between FY 1990/91 and 2007/08, the top tariff rate fell from 355% to 10%. Table 1 summarizes the milestones of this compression of the top tariff rate.

Tariff rates reported in table 1 are the applied, also called the Most Favored Nation (MFN), tariff rates. They are to be distinguished from the bound tariff rates. Signatories to the Uruguay Round Agreements, which gave birth to the WTO, agreed to abide by WTO rules. The bindings take the form of caps on individual tariff lines.[3] Under these rules, countries are encouraged to bind their tariffs during negotiations. Once a country binds a tariff rate, any increase in the rate above the bound level may lead the WTO to authorize retaliatory actions by countries able to demonstrate that the increase has violated their trading rights under WTO rules.

Through earlier trade negotiations under the WTO’s predecessor, the General Agreement on Tariffs and Trade, developed countries, with rare exceptions, had bound their tariffs on industrial products even before the WTO came into existence. Developing countries, in contrast, began binding their tariffs on industrial products in earnest only under the Uruguay Round Agreements. Moreover, they limited the binding in two ways. First, they bound the rates only for a subset of industrial products. Second, for that subset, they chose rates well below the applied rates. As a result, they retained flexibility in setting their applied rates. For products not yet bound, they retained full flexibility, and for bound products, they could raise the applied rates up to the bound rates without attracting retaliatory actions by partner countries.

Agriculture effectively remained outside the General Agreement on Tariffs and Trade’s multilateral discipline until the signing of the Uruguay Round Agreements and the institution of the Uruguay Round Agreement on Agriculture. The latter stipulated that signatory countries must replace all border barriers affecting agricultural products with equivalent tariffs and bind them at the chosen levels. Each country was given the freedom to decide what it considered the tariff equivalent to the existing border barriers. As a result, countries generally chose relatively high equivalent tariffs. Still, 100% of tariffs in agriculture came to be bound in both developed and developing countries.

Under the Uruguay Round Agreements, India bound 71.7% of its industrial tariffs. It left unbound its tariffs on fish and crustaceans (Harmonized System code [HS] 03), minerals (HS 25–HS 27), pharmaceutical products (HS 30), fertilizers (HS 31), some plastics and rubber (HS 39–HS 40), some textiles (HS 50–HS 55 and HS 56–HS 63), footwear and other articles (HS 64–HS 67), base metals (HS 72–HS 79), photographic material and instruments (HS 90– HS 92), armaments (HS 93), and other manufactured articles (HS 94–HS 96).[4] Under the Uruguay Round Agreement on Agriculture, it replaced border barriers in agriculture with equivalent tariffs and bound them on all agricultural products.

India’s bindings generally ranged from 0% to 40% for industrial products and 0% to 150% for agricultural products. Some tariffs on edible oils were bound as high as 300%.[5] In FY 2006/07, the simple average of bound rates was 36.4% compared with the simple average of applied rates of 13.8%. In agriculture, the gap was larger: 117.2% versus 38.2%.[6]

Taking both agricultural and nonagricultural tariff lines together, 12% of tariff lines exceeded the 15% rate. These included 1% of all tariff lines that exceeded the 95% rate and 1.3% of all tariff lines above the 30% rate but below the 95% rate.[7] Industrial products enjoying relatively strong protection included automobiles, textiles, and clothing.

Trade Policy Today

India’s active pursuit of trade liberalization stopped after FY 2007/08. In the following years, the country tinkered with tariff rates on certain products, mostly to favor this or that group of producers, but did not substantially shift policy under the United Progressive Alliance government. However, the National Democratic Alliance government, which came into office in May 2014, has sought to industrialize through import substitution, a policy India had left behind in 1991 after its failure to achieve its goal during the preceding four decades. In promoting import substitution, the government deploys a variety of instruments.

Tariff escalation

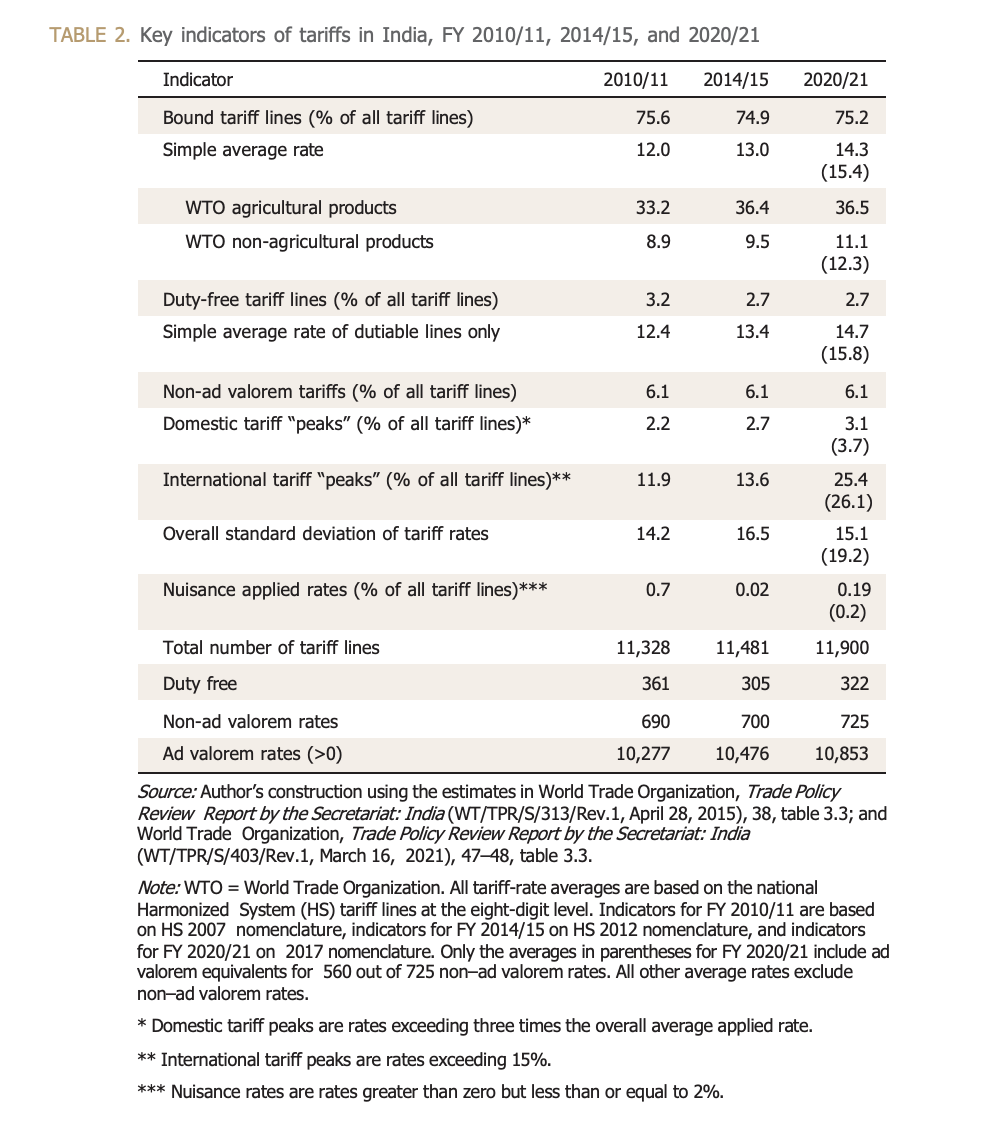

Table 2 provides some key indicators of tariffs in FY 2010/11, 2014/15, and 2020/21. The simple average of tariff rates increased from 12% in FY 2010/11 to 13% in FY 2014/15 and 14.3% in FY 2020/21. The small increase in this average rate masks a larger increase in protection on certain products or product categories. For example, the FY 2018/19 budget raised numerous tariffs from 20% or 30% to 50%, from 10% to 20%, and from 7.5% to 15%,[8] thus doubling or more than doubling them.

Another way to gauge the protective effect is to consider the proportion of tariff lines with a tariff rate above 15%. This proportion was only 11.9% in FY 2010/11 but rose to 25.4% in FY 2020/21. Notably, tariff increases were concentrated principally in nonagricultural products between FY 2014/15 and 2020/21. The simple average of tariffs on nonagricultural products rose from 9.5% to 11.1% during this period.

Tariffs on certain products throw additional light on the high level of protection provided to them. The automotive sector, which contributed 7% of GDP in FY 2019/20, enjoys prohibitive tariffs. In FY 2006/07, the average applied tariff on motor vehicles (HS 8703) was 100%. It was reduced to 60% in FY 2010/11 but returned to 100% in FY 2014/15.[9] By FY 2015/16, the rate had escalated to 125%, where it remained in FY 2022/23. Similarly, since at least FY 2015/16, the customs duty on motorcycles has remained at 100%. Textiles and clothing had customs duties of 10% (some of which were not ad valorem) until FY 2015/16. But in FY 2018/19, they rose to 25%. Finally, until FY 2015/16, mobile phones were not subject to any customs duty. But a 20% duty appeared on them in FY 2018/19, and it remains in place as of FY 2022/23.[10]

Production subsidies

Production subsidies have been part of India’s industrialization tool kit since independence but have been scaled up recently through the production-linked incentives scheme. For domestic producers, these subsidies work similarly to tariffs: they add to the firms’ revenues by raising the domestic price. But whereas tariffs can incentivize only producers of import-competing products, production subsidies can incentivize producers of both import-competing and exportable products. And production subsidies can be targeted at specific firms, whereas tariffs incentivize all firms producing the import-competing product.

The production-linked incentives scheme takes advantage of these differences by offering the subsidy to large firms without discriminating between firms selling the product in the domestic or foreign market. To qualify for the subsidy, a firm must meet certain qualifications predominantly related to the scale of production. Once the qualifications are met, the government typically offers a subsidy of 3% to 5% of incremental sales over a base year for five years. The scheme was launched in March 2000 in three sectors: pharmaceuticals, electronics, and medical devices. In November 2020, it was extended to 10 more sectors, while one other sector was added in September 2021. All these sectors are capital intensive, with apparel and footwear among the sectors left out.

Anti-dumping duties

Anti-dumping (AD) duties are very frequently employed by India to choke off imports from the most efficient suppliers abroad but are rarely discussed in the Indian public policy space. These duties can target specific firms or countries. The most frequent targets are efficient supplier firms or countries. The process of imposing an AD duty begins when domestic firms (producing a like product) file a complaint with the Directorate General of Trade Remedies alleging dumping by foreign firms, and the directorate investigates. If the foreign firms are found to be selling at prices lower than what they charge in their home market, an AD duty is imposed in the amount of the difference between the two prices. Given the in-house nature of the investigation, a positive finding is easy to arrive at. Even if this finding is on shaky ground, the damage is done by the time the targeted country files a complaint with the WTO and the WTO rules in its favor.

A notorious example concerns polymerizing purified terephthalic acid, a key ingredient in polyester fiber production. With its enormous legal resources and political muscle, the major domestic manufacturer of this highly capital-intensive product successfully got the Directorate General of Trade Remedies to repeatedly renew the AD duty for two decades. This duty has played a major role in holding back the emergence of fabric and apparel industries based on man-made fibers.[11]

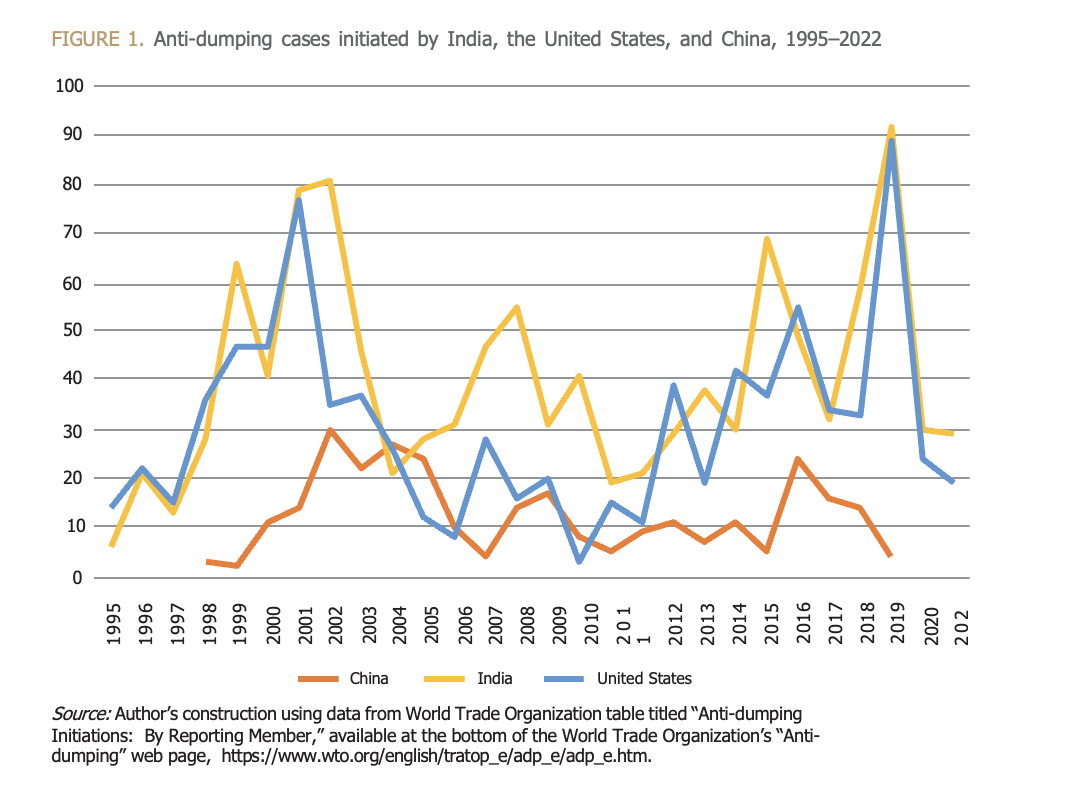

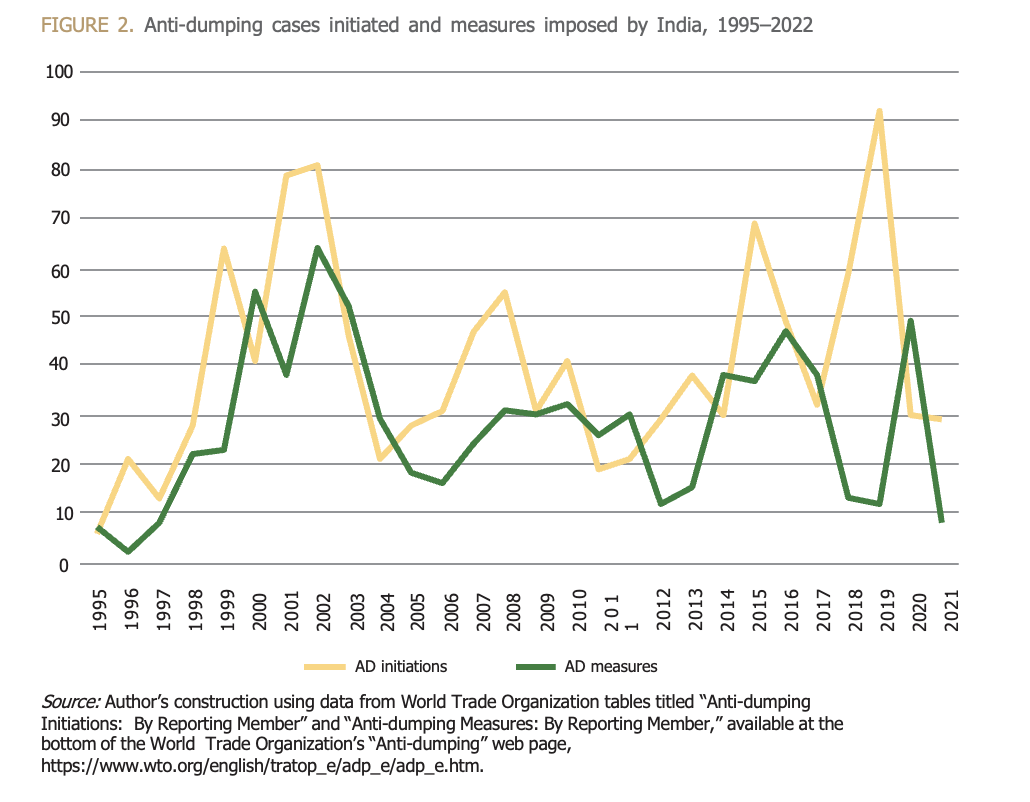

In 2022, the United States accounted for 13.2% of world imports, China 10.6%, and India 2.8%. Yet India has been by far the largest user of AD measures since the mid-1990s. From 1995 to mid-2023, the total number of AD cases initiated stood at 891 for the United States, 548 for the European Union, 294 for China, and a whopping 1,146 for India. Initiation might not result in the imposition of an AD measure (a duty or a minimum-selling-price undertaking). However, qualitatively, imposed AD measure counts tell the same story. Over the same period, there were 628 AD measures in the United States, 266 in China, and 780 in India. The large gap between cases initiated and AD measures imposed in India speaks to the willingness of the Directorate General of Trade Remedies to admit and investigate frivolous cases.[12]

Figure 1 depicts the profiles of AD cases initiated by India, the United States, and China, while figure 2 shows cases initiated and measures imposed by India. Until 1991, strict import licensing provided ample protection so that India had no need for AD actions. It introduced AD measures soon after the 1991 trade reform and imposed the first AD duty in 1992. As figure 1 illustrates, notwithstanding the ultrahigh tariffs that it still had in the 1990s, India quickly became—and remains—an aggressive user of this measure. Figure 2 shows the large gap between the number of cases initiated and actions taken, suggesting that the authorities seem to use the threat of AD effectively by initiating a large number of cases that do not result in action.

India ranks a distant second in the total number of AD measures in force currently. As of June 30, 2023, India had 143 measures in force compared with 497 in the United States and 117 in China. With 137 measures, Brazil ranks a close third. China, despite its large share of world imports and its low tariffs, has been a remarkably light user of AD measures.[13] Its performance on this count, presumably due to its highly competitive manufacturing sector, stands in sharp contrast to that of the United States.

The Case for Liberalization in the Contemporary Context

The recent return to import substitution is supposed to succeed because it has taken place in an environment dramatically different from that of the pre-reform era. Externally, the economy is far more open than it was in the pre-reform era. For example, as of 2022, merchandise imports as a proportion of GDP stood at 21%, compared with less than 10% during the first four decades following independence. Within India, the industry is no longer subject to wholesale socialist-era controls including strict investment licensing, mandatory small scale of production for nearly all labor-intensive products, and near prohibition of foreign investment and import of technology.

To be sure, with imports accounting for a very large proportion of the domestic consumption of many products, their exclusion through tariff barriers can open the way for domestic production to fill the gap. This has been accomplished in sectors such as mobile phones and toys. However, the success of import substitution must be judged not by the health of protected industries but by its capacity to accelerate the entire economy’s growth. So far, import substitution has not delivered on this score, and there are good reasons to believe that this situation will not change in the long run.

In the current context, two mutually reinforcing recent developments make openness in trade policy even more crucial for industrialization and growth. First, advances in transportation and communication technologies have led to a sharp decline in the cost of moving goods and information over long distances. Second, growing technological sophistication has made it possible to break up the production process into more and more components and tasks. These two factors have combined to make it more efficient to divide the production of each product into many components and tasks and to locate each of them where it can be produced or performed at the lowest cost. For example, Apple designs the iPhone in California and purchases components from suppliers in 43 countries spread over six continents. The iPhone “is made of hundreds of individual parts, each manufactured by different suppliers. For example, parts of the iPhone camera and glass screen were built in Japan, elements of the battery were built in China, and the accelerometer—which tracks the phone’s acceleration and enables geographic orientation—was built in Germany.”[14]

These developments have meant that components must pass across multiple borders before they are assembled into the final product. Therefore, any country imposing high tariffs risks being excluded from the supply chain. Indeed, today, the payoff to being a part of a large free trade area is high, since the components can be located in different member countries according comparative cost advantage and cross borders within the free trade area without friction. Import substitution impedes such free flow of components and goods and undermines specialization according to comparative advantage.

In India, it is also commonplace to come across a defense of import substitution by appealing to the so-called infant-industry argument. Such defense has serious problems. For starters, a logical case for protection (as opposed to other forms of intervention) on infant-industry grounds cannot be made.[15] And protection allows even highly inefficient infant firms, which have no prospect of turning into self-sustaining mature firms, to start production. Once these firms have survived behind the high protective wall for several years, they acquire sufficient political clout that the government finds it nearly impossible to withdraw protection. Take the Indian auto industry, which came into existence in 1942 and has been protected against all foreign competition since independence (including in the postreform era) on infant-industry grounds. Today, it is an octogenarian infant protected by a massive 125% tariff on all imported vehicles meant for 10 or fewer passengers.

What Must Be Done

From FY 2003/04 to FY 2019/20, India sustained a growth rate of 7% in real rupees. Because the rupee steadily appreciated in real terms against the dollar during these years, the growth rate in real dollars was significantly higher, at 8.8%. On the back of this growth, India has emerged as the fifth-largest economy worldwide and is expected to become the third largest by the end of FY 2026/27. Nevertheless, the country faces a serious challenge. According to the Periodic Labour Force Survey, 45.5% of its workforce in FY 2021/22 was in agriculture and 39.2% was in industrial and services enterprises employing nine or fewer workers. Value added per worker in agriculture and in these tiny enterprises, which together accounted for 84.7% of all workers in FY 2021/22, is extremely low. India needs to create well-paid jobs to move workers from low-productivity employment to higher-productivity employment. The experience of all countries that have successfully transitioned from primarily agricultural and rural to modern and industrial, such as Taiwan, South Korea, and China, shows that the starting point for this transition is rapid manufacturing growth. Once manufacturing achieves high growth, it sparks demand for and, hence, growth of domestically provided services.

India cannot escape this path if it wants to grow. This path requires India to capture export markets for products in which Indian firms have a comparative advantage. Products dependent on import substitution can grow only as fast as the growth in domestic demand. Exports face no such demand constraint since they can expand continuously by displacing other sellers. India needs to become competitive in a set of products. This, in turn, requires the removal of trade barriers.

Achieve unilateral liberalization

The most desirable course for India is to return to the path it abandoned after FY 2007/08. It should resume unilateral compression of tariffs on industrial products from the top. And it should announce a liberalization road map in advance so industries can begin to adjust based on knowledge of the level of protection they will enjoy every step of the way.

To ensure no loss of fiscal revenue, the goal should be to bring all industrial tariff rates to 7%. This will require lowering rates that are above 7% and raising those below 7%. Each year, especially higher tariff rates should be lowered more and less high ones lowered, such that all rates converge to 7% in five to seven years. Rates below 7% should be raised similarly to reach 7% in five to seven years. This process will entail large reductions in tariffs on products subject to high tariffs, such as automobiles (125%), large motor vehicles (40%), motorized two-wheelers (40%), toys (70%), furniture (25%), textiles (20%–25%), and apparel (20%).

The rationale for a uniform tariff across all products is to effectively contain lobbying pressures for higher tariffs by specific industries. Once the commitment is made, the government can deny higher protection to any specific product on the grounds that it would require it to raise tariffs on other products to maintain uniformity. Indeed, such a regime may deter specific industries from lobbying for higher tariffs in the first place since the benefits of its efforts would potentially become available to all other sectors.

A uniform tariff also promotes transparency in administration. The same customs duty applies regardless of the product. As a result, any incentive to misclassify the product to evade the tariff is eliminated. Additionally, when the uniform tariff is low, the incentive to smuggle is minimized, except for products such as gold that have high value per unit of volume.

A lesser but possibly more politically acceptable reform would be to bring all tariffs within each two-digit Harmonized System code down to one rate: the lowest tariff rate prevailing within that code. Differences would remain between codes. If this rule were followed strictly on the basis of the latest tariff schedule (dated May 1, 2023) available from the Central Board of Indirect Taxes and Customs at the time of writing, considerable liberalization could still be achieved.

Establish free trade agreements

A second avenue to liberalization is a free trade area (FTA), which can be deployed to achieve a liberal trade regime and realign trade flows toward friendly countries. Under this approach, India would eliminate its customs duties on virtually all products imported from its FTA partners over a 10-to-15-year period, while the partners would do the same for products they import from India.

The FTA route to liberalization differs from unilateral liberalization in four respects. First, liberalization is discriminatory because tariffs are eliminated on products traded between FTA partners but retained on those traded with outside countries. Second, FTAs involve reciprocity. While opening its market wider to FTA partners, India can get similarly open access to partner-country markets for its products. This feature can be highly beneficial to Indian exports. Third, within an FTA, tariffs are eliminated rather than just lowered. Within the limited geographical region, full free trade is achieved. Finally, to get around the possibility that an FTA member with a low external tariff on a product may import it from outside and then sell it in a partner country with a high external tariff on the same product, FTAs require elaborate product-wise rules of origin. If these rules of origin are overly demanding, they may effectively neutralize the liberalization achieved by eliminating tariffs. Therefore, the temptation to adopt highly restrictive rules of origin must be resisted. Geopolitically, India faces its strongest challenge from China. China is the largest source of India’s imports, and India is interested in realigning its trade away from China and toward other trading partners. This objective can be achieved by forging FTA agreements with the United Kingdom and the European Union and strengthening its current FTA with the ASEAN (Association of Southeast Asian Nations) Free Trade Area. These FTAs will create a large free trade space around India and will go a long way toward realigning India’s trade and making the country an attractive destination for foreign investors. India has a significantly larger workforce than any other country. Locating production activity will give investors access to this workforce and allow for duty-free movement of components and final products over a large multi-nation space. In due course, India can replace China as the hub of supply chains.

Limit anti-dumping measures

AD measures should be used with discretion, and AD duties should be allowed to expire after the end of their initial term. India has shown a strong tendency to repeatedly renew the duties once imposed. This is against the spirit of the instrument, since its purpose is to give domestic industry time to adjust, not to provide permanent protection.

Concluding Remarks

India is growing at an annual average rate of approximately 7%—2 to 3 percentage points below its potential. There is no reason why India cannot grow at rates similar to those experienced by South Korea, Taiwan, Singapore, and China during their fast-growth phases. With the government building physical and financial infrastructure at breakneck speed and new labor codes soon to be implemented, the main element in its policy regime is a genuinely liberal trade policy with low overall tariffs and a network of effective FTAs. Putting these measures in place promises to return the global economy to the old normal in which India became one of the world’s two largest economies in less than four decades.

Notes

[1] This section is based almost entirely on Arvind Panagariya, “Why We Must Trade Freely: Five Reasons Why India Should Review Its Current Protectionist Policy,” Times of India, November 21, 2021.

[2] India’s fiscal year begins on April 1 and ends on March 31. Accordingly, FY 2007/08 refers to the period from April 1, 2007, to March 31, 2008.

[3] A tariff line is a product as defined by a system of code numbers. WTO trade and tariff data employ the Harmonized System (HS) of codes. For example, two-digit codes HS 01 to HS 05 represent all animals and animal products, HS 06 to HS 15 represent vegetable products, HS 16 to HS 24 represent foodstuffs, HS 25 to HS 27 represent mineral products, HS 28 to HS 38 represent chemical products, and so on. Each two-digit product group can be further subdivided into finer products represented by, say, four-digit codes. For example, HS 01 represents live animals. Within this category, HS 0101 represents live horses, asses, mules, and hinnies; HS 0102 represents live bovine animals; HS 0103 represents live swine; HS 0104 represents live sheep and goats; and HS 0105 represents live poultry. Each of these codes represents a tariff line with an associated tariff imposed by the country under consideration.

[4] World Trade Organization, Trade Policy Review Report by the Secretariat: India (WT/TPR/S/403/ Rev.1, March 16, 2021) 49, ¶ 3.29.

[5] World Trade Organization, Trade Policy Review Report by the Secretariat: India (WT/TPR/S/182/ Rev.1, July 24, 2007), 37, ¶ 23.

[6] World Trade Organization, Trade Policy Review Report, 2007, table III.1.

[7] World Trade Organization, Trade Policy Review Report by the Secretariat: India (WT/TPR/S/249, August 10, 2011), 45, chart III.1.

[8] Ministry of Finance, “Budget 2018–19: Speech of Arun Jaitley,” February 1, 2018 (New Delhi: Government of India).

[9] World Trade Organization, Trade Policy Review Report by the Secretariat: India (WT/TPR/S/313/ Rev.1, April 28, 2015), 108, ¶ 4.51.

[10] Unless otherwise stated, duty rates on specific products are taken from the customs schedules of the Government of India, available at https://www.cbic.gov.in/entities/cbic-content-mst/Njk%3D.

[11] See Arvind Panagariya, “Trade Policy Has No Clothes,” Times of India, March 10, 2023.

[12] Data on cases initiated and AD measures imposed can be found in the tables available at the bottom of the WTO’s “Anti-dumping” web page, https://www.wto.org/english/tratop_e/adp_e/adp_e.htm.

[13] World Trade Organization, Report of the Committee on Anti-dumping Practices (G/ADP/35, October 26, 2023), annex C.

[14] Laura Ross, “Inside the iPhone: How Apple Sources from 43 Countries Nearly Seamlessly,” Thomas, July 21, 2020, https://www.thomasnet.com/insights/iphone-supply-chain/.

[15] Arvind Panagariya, “Other Common Arguments for Protection,” chap. 3 in Free Trade and Prosperity: How Openness Helps the Developing Countries Grow Richer and Combat Poverty (New York: Oxford University Press, 2019).