Reliable electricity supply is vital for India’s manufacturing sector. India has made great strides in increasing the accessibility of electricity to 99.6% of the population in 2021 compared to 50.3% in 1993. And per capita electricity consumption grew 6.75 times during the 1980–2021 period.[1] Despite this progress, manufacturers continue to face two significant challenges: unreliable power supply and high electricity prices. This paper argues that these problems are a result of financially distressed electricity distribution companies (DISCOMs), which form the last leg in the electricity supply chain. Consequently, DISCOMs’ financial health directly affects manufacturers’ access to uninterrupted and cost-effective power supply.

In India, electricity is supplied at government-regulated prices, known as electricity tariffs. Because of perverse political incentives, tariff rates for farmers and households are heavily subsidized, as these groups form a large voter base. The government covers the subsidy partially; and to offset the revenue losses resulting from the subsidized tariffs, it sets higher tariff rates for manufacturers and other commercial and industrial consumers. The disparity is stark: Manufacturers in Maharashtra pay triple the farmers’ rate, and in Karnataka, farmers receive free electricity while manufacturers pay about 18.5% above the average cost of supply.[2]

This pricing structure triggers a cascade of problems. Subsidized consumers tend to overconsume electricity, causing actual usage to deviate from demand forecasts used in tariff setting. Delays in government subsidy payments to DISCOMs compound these distortions, severely straining DISCOM finances. Unable to generate adequate revenue, DISCOMs cannot invest in infrastructure upgrades, causing interruptions in the electricity supply. For manufacturers, it is a losing proposition: They pay inflated tariffs but receive unreliable service. The economic cost is substantial, with losses to the manufacturing and services sectors due to power shortages estimated at 1.09% of India’s GDP in the fiscal year (FY) 2015/16.[3]

To overcome these challenges, manufacturers seek alternatives such as open access and captive power plants (captives). Open access enables manufacturers to buy electricity directly from power generators, while captives, a special form of open access, allow them to generate their own power. However, manufacturers’ migration to these alternatives hurts the revenues of state-owned DISCOMs, which dominate the distribution sector. To protect those revenues, state governments curb the adoption of these alternatives by creating regulatory constraints and pricing interventions and making it difficult for manufacturers to access inputs required for captive plants.

Thus, manufacturers find themselves in a catch-22, in which electricity provided by DISCOMs is unreliable and expensive, but governments stifle access to alternative sources. To address these issues, we recommend reforms in three key areas: (1) reforming prices to reflect market conditions, and switching from subsidies to direct-benefit transfers; (2) easing regulation of alternative electric- ity sources such as through open access, captive generation, and energy banking; and (3) reorganizing the electricity distribution sector to foster competition and improve efficiency.

This paper first examines the unreliable supply of electricity to manufacturers and shows how they bear a disproportionate tariff burden because of perverse political incentives and the poor financial health of DISCOMs. It then explores the second-order problems that arise from these challenges, such as regulatory hurdles and pricing interventions created by state governments to disincentivize manufacturers who opt for open access and captives. Finally, it recommends reforms to address these issues.

Unreliability of Electricity Supply

India faces a persistent problem with unreliable electricity,[4] and this has a direct impact on manufacturers and other commercial and industrial consumers, who consume nearly half of the nation’s power supply.[5] It is not a minor inconvenience: It can halt production, delay schedules, and increase operational costs. Power shortages contributed to an estimated USD 22.7 billion in losses across the manufacturing and services sectors in FY 2015/16, or 1.09% of India’s GDP.[6] Further, manufacturers can see their annual revenues drop up to 7.7% because of power shortages.[7] Over 20% of manufacturers in the 2022 World Bank Enterprise Survey of India reported that electricity interruptions affect their production, and 13.1% of manufacturers identified interruptions in electricity supply as a major constraint in their operations.[8]

There are two related sources of electricity supply interruptions. First, there are technical issues within transmission and distribution networks—such as malfunctioning transformers. While these issues can occur in the course of ordinary business, poor quality and inadequate infrastructure exacerbate them. Consider power transformers in the electricity distribution system, which reduce the voltage of electricity to levels appropriate for use by the end consumer. Transformer failure rates in Indian states typically lie between 7% and 18%—much higher than in developed countries, where the rate is between 2% and 3%.[9] In July 2024, nearly 27,000 transformers failed in Uttar Pradesh within a span of 25 days. Of these, about 40% suffered damage due to overloading caused by demand surges, indicating inadequate infrastructure. A further 35% suffered damage due to cable and wiring issues, indicating poor-quality infrastructure.[10]

The Indian electricity system generally classifies consumers into four main categories: agricultural, domestic, commercial, and industrial. Manufacturers and associated firms in the supply chain typically fall in the commercial and industrial categories. In FY 2021/22, commercial and industrial consumers consumed 49.45% of India’s electricity supply. Data from Ministry of Statistics and Programme Implementation, Government of India, Energy Statistics India—2023 (New Delhi, India: National Statistical Office, 2023).

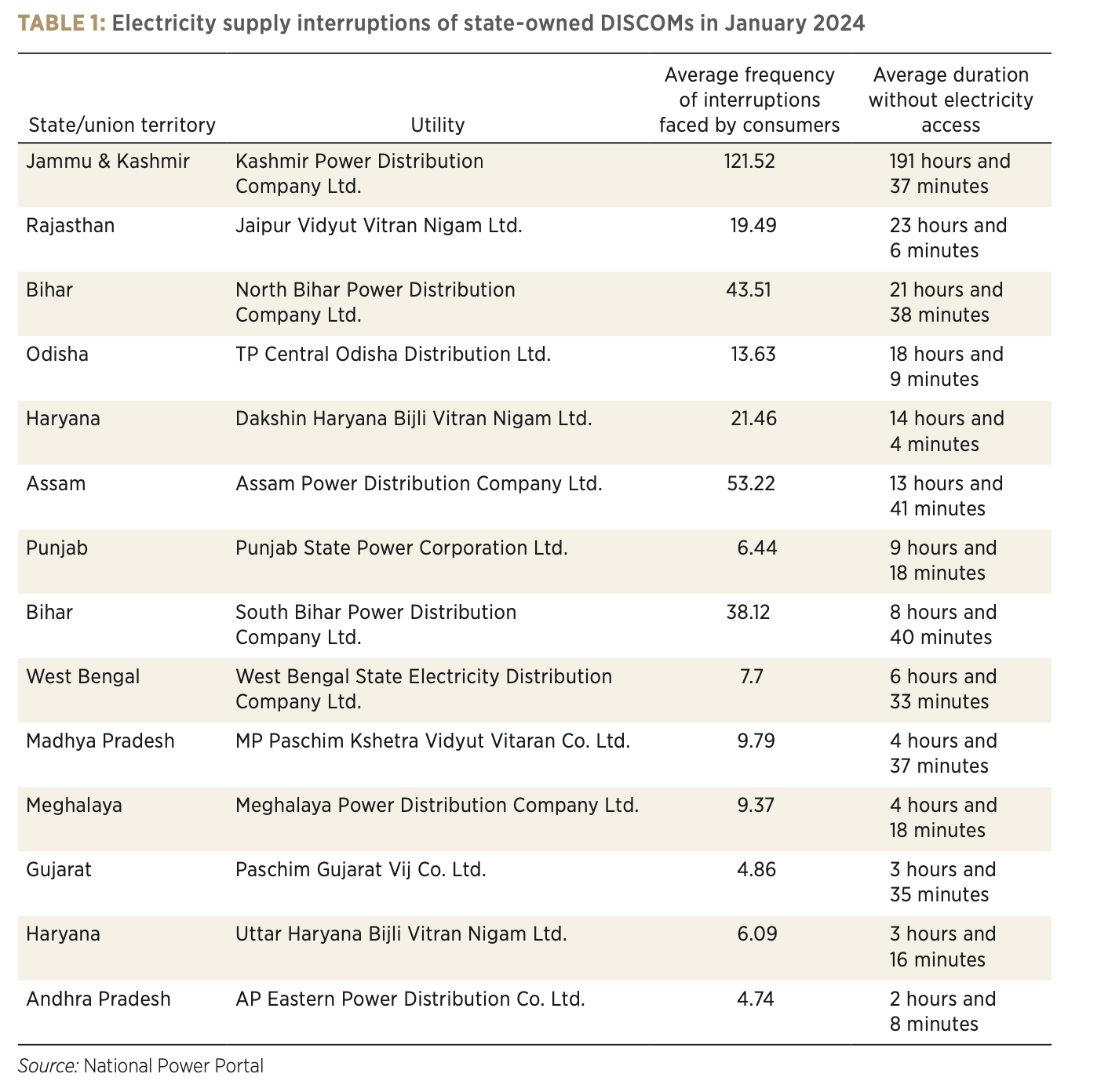

The second source of power interruptions is shortage of electricity supply relative to demand. Electricity shortages can follow a surge in demand, such as during heatwaves. Or they can occur because of supply-side challenges, such as coal shortages. With shortages, consumers experience power cuts. When short- ages are predictable, grid managers can plan these cuts in advance. However, unexpected surges in demand lead to unscheduled power cuts, which can be particularly disruptive for manufacturers. In response to power cuts due to elec- tricity shortages in June 2024, the head of a trade body in Rajasthan reported, “Power cuts always impact production, delay delivery orders, and escalate manufacturing costs, but unscheduled cuts, irrespective of the duration, are worse.”[11] Information about past power interruptions can help manufacturers form more accurate expectations and make better decisions about their operations. Information about power cuts experienced in recent months is available through DISCOMs’ reporting of power supply data to the National Power Portal, which tracks the frequency and duration of interruptions each month (see table 1).

The portal reports these data as the average interruptions across all consumer categories (agricultural, domestic, commercial, and industrial) of each DISCOM. Different consumer groups may experience different durations of interruptions depending on location and other factors, but these averages pro- vide a useful estimate of the interruptions a consumer may expect in a month. Although disaggregated data for different consumer groups are unavailable, reports indicate that industrial consumers, including manufacturers, fare worse since they are larger consumers of electricity.[12]

In January 2024, electricity consumers (averaged across different consumer categories) in Kashmir experienced about 120 interruptions in power supply, totaling about eight days without power. In the same month, consumers in Assam faced about 53 interruptions. Table 1 presents information on interruptions faced by all consumers of state-owned DISCOMs, as reported for January 2024 to the National Power Portal.[13]

These electricity shortages occur in a market in which prices are fixed through regulated tariffs. When prices are not regulated but allowed to adjust with market forces, they rise in response to higher demand or reduced supply. This is because market prices act as signals wrapped in incentives: They encourage consumers to reduce consumption and producers to increase supply in response to shortages. However, prices in India’s electricity sector are politically determined and lack the characteristics of market prices. They fail to properly incentivize consumers or producers, thereby perpetuating power shortages. As we explore in the next section, this disconnect is tied to how electricity tariffs are set.

Higher Tariffs for Manufacturers

Manufacturers not only face interruptions in electricity supply from DISCOMs but are burdened with higher tariffs compared to other consumer groups. This distorted tariff structure is a result of a regulatory system in which political considerations shape tariff setting. Through cross-subsidization, regulators keep tariffs artificially low for households and farmers while shifting the cost burden onto manufacturers and other commercial and industrial consumers.

These pricing distortions are worsened by the inefficient operations of the state-owned DISCOMs that dominate electricity distribution. Operating as regional monopolies, these DISCOMs suffer from poor operational efficiency and sustained financial losses and have limited incentives for improvement. The combination of cross-subsidization and DISCOM inefficiencies creates a vicious cycle: Manufacturers face higher tariffs to compensate DISCOMs for both the subsidies and the operational losses, while DISCOMs lack the resources and incentives to improve service quality.

To better understand the challenges faced by manufacturers, we begin by examining the structure of India’s electricity supply system and how tariffs are set.

The electricity supply system

Prior to the 1990s, electricity was supplied through State Electricity Boards. These functioned as monoliths, managing generation, transmission, and dis- tribution within their respective state governments. Transmission involves carrying high-voltage electricity from power generation plants to substations, and distribution involves supplying electricity to end consumers. The sector was restructured in the late 1990s, when State Electricity Boards were corporatized and split into separate entities for generation, transmission, and distribution— each functioning as an independent state-owned corporation. This restructuring aimed to improve operational efficiency.[14]

The Electricity Act of 2003 marked the next step in the sector’s evolution. As electricity falls under the constitution’s Concurrent List, this union-level legislation sought to consolidate the previously fragmented laws relating to generation, transmission, distribution, and trading, and it aimed to promote competition in these various functions.[15] The act delicensed electricity generation and allowed private-sector entry into transmission and distribution.[16] It also introduced the concept of open access, which allows commercial and industrial consumers to buy electricity directly from power generators, thereby increasing choice and competition in the sector.[17] But, as we shall see in the next section, the benefits to manufacturers from open access remain limited.

The 2003 act provides multiple layers of oversight and coordination. State Electricity Regulatory Commissions are responsible for issuing licenses to public and private players and for setting electricity tariffs. Additionally, State Load Despatch Centres are tasked with managing the flow of electricity within each state. They are meant to coordinate between power generators and DISCOMs to balance electricity supply and demand. The centers are also responsible for approving requests from consumers and suppliers in the open-access system, facilitating access to electricity for everyone from private generators to consumers opting for open access.

The impact of these reforms has been uneven across the electricity supply chain. The power generation sector has strong private participation, with over 50% of production capacity being privately owned.[18] But the distribution sector remains predominantly state controlled, largely because of state govern- ments’ reluctance to cede control. Distribution involves last-mile connectivity of electricity supply to consumers and therefore holds political significance. The distribution sector is where the consumers pay the price of electricity, and so state governments can give subsidies for political benefit. As a result, state- owned DISCOMs account for over 90% of the electricity sold by DISCOMs in India. Only five of India’s 28 states and two of its 8 union territories have private DISCOMs.[19] Mumbai is the only distribution region that has retail competition, offering consumers choice between multiple DISCOMs.

Tariff setting

As stated earlier, the tariff structure for DISCOMs is regulated by the State Elec- tricity Regulatory Commissions. Electricity distribution utilities act as regional monopolies, except in Mumbai. In the absence of competition, the market cannot discipline DISCOM prices and profits. To address this, the Electricity Act of 2003 requires the regulator to set tariffs in a way that allows DISCOMs to cover their costs and earn a regulated profit. The process is guided by the National Tariff Policy issued by the union government.

The tariff-setting process begins with a DISCOM submitting a tariff petition to the regulator. This petition outlines the projected costs the DISCOM expects to incur, including operational expenses and revenue requirements, based on anticipated consumer demand, consumer composition, and other factors. The regulator reviews these projections to determine an appropriate revenue requirement that ensures the DISCOM earns a regulated profit. This process includes public hearings in which various stakeholders can participate. Based on this review, the regulator issues a tariff order that sets electricity rates for different consumer categories, typically over a multiyear period.

However, actual costs and revenues often differ from projections because of factors such as changes in the average cost of supply or changes in consumer composition and demand. In such cases, DISCOMs are permitted to file petitions to revise tariffs based on audited financials to make up for losses they may incur. This process takes at least two years since the revisions are based on audited financials. Since most DISCOMs are state owned, tariff revisions are delayed or avoided due to political considerations. Thus, with tariff rates being set over multiyear periods and revisions being avoided, tariffs tend to be sticky.[20]

This stickiness means DISCOMs struggle financially. For instance, in FY 2022/23, state-owned DISCOMs suffered more losses (INR 623.86 billion) than the entire union budget allocated to providing clean drinking water to millions of households through the Jal Jeevan Mission scheme (INR 600 billion).[21] Additionally, as detailed in the next subsection, political considerations further distort the tariff structure.

Cross-subsidization and higher electricity tariffs for manufacturers

In this system of regulated tariff rates, manufacturers face the brunt of cross- subsidization: They are charged higher tariffs to subsidize other consumer groups, particularly households and farmers. Twenty-one of India’s 28 states and four of its 8 union territories provide tariff subsidies to farmers and households.[22] Election promises to expand subsidies are common, such as Punjab’s free electricity for farmers[23] or Andhra Pradesh’s tariff freezes for rural households.[24] Of the total electricity subsidy expenditure by state governments, farmers and households receive about 75% and 20%, respectively.[25] While the state exchequer generally pays for these subsidies, manufacturers also bear the burden, as we demonstrate below.

The government’s subsidization of electricity for farmers and households creates two problems. First, state governments announce subsidized rates and promise to pay DISCOMs the difference between the regulator-set tariff and the subsidized tariff. However, they often delay making these payments, which disrupts the DISCOMs’ cash flows and thereby hampers their ability to provide reliable electricity.

Second, state governments simply lower tariff rates for favored consumer groups, but paying subsidies is financially burdensome. To reduce the burden, state governments influence regulators to set tariffs lower than the cost of supplying electricity, in order to reduce the amount of subsidies consumer groups would have to pay. But lowering tariffs reduces DISCOM revenues, which must be covered by charging other consumers, particularly commercial and industrial consumers, higher tariff rates. This is because the regulator-set tariffs are set to ensure that DISCOMs’ total revenues cover their costs and allow for a regulated profit.

This tariff structure distorts the electricity market.[26] Farmers and households with cross-subsidized tariff rates are incentivized to consume more power from the grid. Meanwhile, manufacturers, which now face a higher tariff burden, are incentivized not only to consume less but to exit the state-owned electricity sector and seek alternatives, a topic explored in the next section. As these high-tariff-paying firms exit the system, DISCOMs’ finances face further strain, leading to even higher tariffs for the firms that did not exit. This cycle increases the price of electricity for manufacturers that rely on state-owned DISCOMs for their power needs.

To reduce cross-subsidies, the National Tariff Policy of 2016 required the regulators to limit tariffs to within 20% above or below the average cost of supply. However, the regulators routinely violate this guideline. In FY 2018/19, more than half the quantity of electricity sold violated the ±20% limit.[27] In the same period, all commercial and industrial users overpaid for electricity by INR 523.37 billion, while agricultural and domestic consumers benefited from under- payments totaling INR 723.29 billion.[28]

More recently, in FY 2022/23, farmers in Maharashtra paid a tariff 53.8% lower than the average cost of supply, while manufacturers were charged a tariff up to 40.4% more than that cost. Overall, manufacturers were charged more than three times the tariff paid by farmers. In Bihar, manufacturers were charged about 32.3% more than the average cost of supply in the same period.[29]

Depending on the product, some of these higher input costs are passed on to domestic consumers. However, high electricity tariffs make Indian firms less competitive abroad. A World Bank study on the relationship between energy prices and trade patterns across 43 countries from 1991 to 2012 estimated that removing cross-subsidization could increase India’s net manufacturing exports by up to 9.5%.[30]

Inefficiencies of state-owned DISCOMs

Manufacturers face the burden of cross-subsidization through higher tariffs. They are also trapped in a system dominated by state-owned DISCOMs mired by financial and operational inefficiencies.

On average, state-owned DISCOMs lost INR 0.61 per kWh of electricity supplied during FY 2022/23.[31] In contrast, private DISCOMs performed much better, reporting a profit of INR 0.16 per kWh sold. The aggregate sector loss stood at INR 572.23 billion, almost entirely on account of state-owned DISCOMs. Despite the efficiency of private DISCOMs, manufacturers rarely benefit, as more than 90% of electricity distribution remains under state-owned DISCOMs.[32]

The lack of competition in the electricity distribution sector reduces DISCOMs’ incentives to improve efficiency. Additionally, the losses of the state-owned DISCOMs are perpetually absorbed by state governments, which allows them to continue being inefficient. A competitive market, in which losses act as hard constraints, would force DISCOMs to offer reliable and affordable electricity to attract consumers at the retail level. Similarly, competing for dis- tribution rights in specific geographic areas would force companies to submit more cost-effective bids to state governments. Although the Electricity Act of 2003 was intended to promote competition, most state governments do not allow private participation in the distribution sector, which diminishes the incentive of state-owned DISCOMs to enhance service and operational efficiency.

The Ministry of Power’s annual DISCOM ratings assess profitability, financial sustainability, and operational efficiency, along with the external envi- ronment, including factors like timely payment of subsidies by the government. A higher rating indicates better performance. States with multiple DISCOMs, including privately or state-owned ones, score on average 56.62 higher than the 36.79 average in states with a single (state-owned) DISCOM. This performance gap is even more pronounced between states where at least one private DISCOM operates and states without private-sector participation: an average rating of 68.16 compared to 42.43.[33]

These figures also highlight the positive impact of competition and private-sector participation on the efficiency and performance of DISCOMs. Competition creates incentives for performing better and allows DISCOMs to learn from competitors. Reorganizing the industry to allow multiple players to operate can play a vital role in improving DISCOMs’ performance.

While one way to promote competition is to facilitate entry of more private DISCOMs, another is through open access and captive power generation. These options give manufacturers more choice and greater control over the price and reliability of electricity.

Second-Order Problems: Challenges In Accessing Alternative Electricity Sources

As we have seen, manufacturers in India face critical challenges with electricity access, including high tariffs and interruptions in supply from DISCOMs. To mitigate these issues, manufacturers have an incentive to turn to open access.

Open access allows manufacturers to use the state or central transmission and distribution network to source electricity through independent third-party power producers, power exchanges, or captive power.

Purchasing from third-party generators typically involves signing long- term Power Purchase Agreements, which ensure a steady supply of electricity at agreed-upon rates. Alternatively, manufacturers with flexible requirements can buy electricity directly from exchanges like the Indian Energy Exchange, which has over 90% market share.[34] These platforms operate as centralized marketplaces in which power generators and consumers trade electricity in real time, and the prices reflect demand and supply.

Captive power generation, another open-access option, allows manufacturers to produce their own electricity by setting up a power plant. Captives are particularly appealing because they enjoy exemptions from cross-subsidy surcharges (levied to subsidize other consumer categories) and additional surcharges (to compensate DISCOMs for unused infrastructure when consumers exit), making electricity from captive generation up to 30% cheaper than DISCOM tariff rates.[35] A captive plant can be operated either by a single manufacturer or jointly by a group of manufacturers who share ownership to collectively cover costs. However, the group-captive option requires manufac- turers to meet regulatory thresholds, such as collectively owning a minimum of 26% of the plant and consuming at least 51% of the electricity generated.[36]

Manufacturers may choose alternative power generators through open access, but they remain connected to state-owned networks. Although these manufacturers no longer purchase electricity from DISCOMs, they still rely on transmission companies and DISCOMs to transport electricity. This arrangement requires approvals and incurs charges for using the existing infrastructure.

When shifting away from DISCOM-sold electricity, manufacturers encounter second-order challenges. State governments and DISCOMs, concerned about losing revenue from manufacturers, impose regulatory constraints and price interventions to limit the adoption of these alternatives. For example, manufacturers using open access are charged cross-subsidy surcharges.

Furthermore, manufacturers relying on captive generation face input-access restrictions, particularly during fuel shortages.

Regulatory constraints and uncertainty

Manufacturers seeking open access must obtain multiple permissions and approvals from state bodies and DISCOMs, a process that can take several months.[37] This adds significant time, cost, and uncertainty.

To begin with, the eligibility threshold—typically a minimum load of 1 MW for most states—restricts many smaller manufacturers.[38] Only in 2022 did this threshold drop to 100 kW for renewable energy consumers, but even this concession remains limited to green energy sources.[39] To buy electricity from a generator within the same state, eligible manufacturers have to secure permissions from the State Load Despatch Centre. These centers are responsible for management of electricity demand and supply,[40] but they frequently delay applications, citing inadequate electricity carrying capacity.[41] Industry organizations have reported that since there is no transparency regarding congestion and network capabilities, the businesses find it difficult to contest these delays.[42]

Manufacturers with short-term energy requirements can buy from electricity exchanges. But they need to acquire a No Objection Certificate from a nodal agency, which may be the transmission company, DISCOM, or State Load Despatch Centre, depending on the state. The certificates specify the power quantity that the consumer can buy and the duration of permissible contracts. The validity of these certificates may also vary. They may be issued at monthly or quarterly intervals and need frequent renewals—adding to the manufacturers’ administrative burden.[43] The exchanges also need to keep track of these certificates to make sure the consumers remain compliant with the regulation, which adds to the costs of transacting on these exchanges. This causes delays. For instance, in Telangana, developers seeking permissions often receive approvals valid for only two years, despite planning and applying for longer-term access. Even the renewals sometimes take six to nine months.[44]

While captives offer greater reliability, operating them involves additional functions like managing the inputs and production process. Group captives negotiate this tradeoff by including a captive power-plant developer as part of the group. The developer is typically a specialized entity responsible for setting up, operating, and managing the electricity generation infrastructure, ensuring reliable power supply. The other members of the group act as consumers who share ownership and benefit from the electricity produced. But with the presence of a developer, state governments see this as a way manufacturers skirt the regulations and benefit from exemption from cross-subsidy and additional surcharges. In 2018, Maharashtra imposed additional surcharges on group captives, even though they were explicitly exempt under the Electricity Act of 2003. While this decision was struck down by the Supreme Court in 2021, the three years spent on litigation caused policy uncertainty.[45] Going further, Gujarat does not explicitly recognize group captives as an option.[46]

Renewable-energy-based captive power plants must also deal with fluctuations in energy output. This variability occurs because the sources of this energy, such as solar and wind, naturally fluctuate. Energy banking allows captives to feed excess energy into the grid, essentially using the grid as a giant battery. For instance, for solar-based captives, the banked energy can be withdrawn when solar generation is low, such as during cloudy days or at night.

However, increasingly restrictive regulations have made energy banking less economically viable.[47] Rajasthan imposes restrictions on energy withdrawal during peak hours. This creates operational challenges, as manufacturers cannot access their banked energy when they need it most, forcing them to either modify their production schedules or bear higher costs for arranging power from other sources.[48] Some states, like Tamil Nadu, have increased energy-banking charges. These are calculated as a percentage of the total banked energy and increased from 2% to 14% between 1986 and FY 2023/24.[49] This means manufacturers must forfeit a larger portion of the electricity they bank with the grid, raising their operational costs.

Together, these regulations act as hurdles for manufacturers seeking to switch to open access. They reflect a broader tension between promoting competition in the electricity market and protecting the financial viability of state-owned DISCOMs, whose ongoing challenges stifle the development of a truly open and efficient energy market that would benefit manufacturers.

Pricing interventions

Manufacturers opting for open access must pay charges for the use of infrastruc- ture required for transmission and distribution of electricity. Specifically, they must pay transmission charges to the state transmission company and wheeling charges to the regional DISCOMs for using their networks. These charges vary across states. For instance, in 2022, the wheeling charge in Andhra Pradesh was INR 0.12/kWh, while the charge in West Bengal was INR 0.99/kWh.[50] Transmission charges are waived in small territories such as Goa and Chandigarh, but in 2022, they were INR 0.82/kWh in Maharashtra.[51] Although these charges are intended to reflect the cost of infrastructure usage, disparities in the charges add complexity and make it difficult for manufacturers operating across states to manage their operations and operating costs.

In addition to transmission and wheeling charges, which are charges for the service of transporting electricity, cross-subsidy and additional surcharges are imposed on open-access and captive consumers for opting out of DISCOM-supplied electricity. Cross-subsidy surcharges are effectively a tax on consumers like manufacturers who opt for open access. In 2022, manufacturers had to pay an extra INR 1.88/kWh in Delhi and INR 1.95/kWh in Karnataka, increasing the cost of open access.[52] Despite the National Tariff Policy of 2016, which advocated a gradual reduction in these surcharges, they instead rose in many states between FY 2016/17 and FY 2021/22.[53]

When manufacturers consider migrating to open access, they face addi- tional surcharges to allow DISCOMs to recover losses from exiting firms. These charges also vary widely across states. For instance, in 2022, the additional surcharge was INR 1.32/kWh in Maharashtra and INR 1.09/kWh in Haryana.[54] Further, in 2021, Haryana imposed an unprecedented grid-stability charge of INR 1.5/kWh on open-access consumers.[55]

Collectively, these pricing interventions ensure that the financial health of DISCOMs remains dependent on cross-subsidization and additional charges.[56] This results in manufacturers either paying high tariffs or facing barriers in exiting from state-owned electricity systems to potentially more reliable and lower-priced sources of electricity supply.

Input-access restrictions

Captive power plants depend on ease of access to primary inputs. But coal-based captives often struggle to operate at full capacity because of coal shortages.[57] During national coal shortages, governments prioritize supply of coal to state-owned power generation plants. In 2021, because of coal shortages, several captives reported facing shutdowns, which disrupted manufacturing activities across key sectors such as steel and cement.[58] These input-access restrictions diminish the benefits from captives and reinforce the dependence of manufacturers on DISCOMs, perpetuating the cycle of unreliable and expensive electricity supply. To address these challenges, a transparent, market-based coal allocation mechanism could be introduced to ensure equitable distribution across public utilities and captives, even during supply shocks. Such a system would allow captives to secure coal at competitive rates, reducing manufacturers’ reliance on grid power and enabling more flexibility in managing production costs.

In sum, open access and captive power generation hold promise in providing Indian manufacturers reliable and cost-effective electricity. However, multiple barriers restrict their adoption. Regulatory constraints and uncertainty, pricing distortions, and limits on accessing inputs continue to bind manufacturers to DISCOM-supplied electricity.

Policy Recommendations

To resolve the electricity supply challenges facing Indian manufacturers, we propose a set of reforms to address the issues highlighted in the previous sections: pricing distortions, regulatory barriers to open access and captives, and inefficiencies in the electricity distribution market. We recommend (1) instituting pricing reforms, including a switch to a direct-benefit transfer system; (2) easing regulatory barriers to open access and captive generation, energy banking, and energy input access; and (3) reorganizing the electricity distribution sector to promote competition and incentivize DISCOMs to become more efficient.

The first set of reforms addresses pricing. As shown, cross-subsidization results in price distortions, which affect the financial health of DISCOMs and their ability to provide uninterrupted electricity supply. The optimal solution would be to rationalize tariffs across all consumer groups to reflect market prices. But there are political limitations to the complete removal of subsidies.

To overcome transitional gains traps, we propose a shift to a direct-benefit transfer system.[59] In this system, electricity tariffs would be consistent across consumer groups and based on market conditions. The scheme would provide the difference between the market price and the subsidized rate as a direct cash subsidy to farmers and households. This would have three related effects. First, since electricity prices would be based on demand and supply, it would incentivize farmers and households to adjust their demand, where subsidized prices now lead to overconsumption. This would reduce distortions caused by differential tariff rates levied under cross-subsidization. Second, it would discipline state governments, as they could not hide behind DISCOM losses. It would be more infeasible politically to delay benefit transfers to voters than to delay subsidy payments to state-owned DISCOMs. Third, it would help DISCOMs stay financially stable by allowing tariffs to reflect actual costs, which would reduce financial pressure and help them invest in better infrastructure, ultimately making supply more reliable for manufacturers.

As the financial pressure on DISCOMs eased, it would reduce the incentive for firms to exit the system, thereby reducing the incentives for state govern- ments to impose cross-subsidy and additional surcharges on commercial and industrial consumers opting for open access or captives. Implementing direct- benefit transfer would also streamline the path toward reducing cross-subsidies, envisioned in the National Tariff Policy of 2016.

The second set of reforms addresses regulatory barriers, aimed at easing restrictions on alternative electricity sources such as open access and captive generation. This would give manufacturers greater flexibility to manage their energy needs more efficiently. As explored in previous sections, delays in securing approvals and the lack of transparency in the availability of transmission and distribution infrastructure create barriers for manufacturers seeking alternatives to DISCOM supply. Delays not only increase uncertainty but add costs for manufacturers dependent on reliable and affordable power sources.

A centralized approval platform for open-access applications may be established to provide clear, consistent, and publicly accessible information on network availability and approval status. This system would reduce the discretionary power of state governments and DISCOMs to delay or reject appli- cations based on ambiguous technical constraints, such as network congestion. Moreover, addressing energy-banking restrictions would provide manufacturers with greater flexibility in managing captive generation. Removing restrictions on withdrawal during peak periods would encourage greater use of renewable sources such as solar and wind.

Restricted access to coal poses another challenge for manufacturers who rely on captives. During national coal shortages, captives often face supply constraints, as coal is prioritized to go to public utilities. To mitigate this access problem, a transparent market-based coal allocation system could ensure that captives can secure coal at competitive rates even when there are supply shocks. This approach would reduce manufacturers’ reliance on grid power and enable production adjustments based on price changes.

The third set of reforms involves reorganizing the electricity distribution sector to promote competition, lower costs, and improve uninterrupted power supply for manufacturers. As we have shown, states with multiple DISCOMs and at least one private DISCOM perform better than those with a state-owned monopoly. The lack of competition reduces incentives to improve efficiency.

Thus, reorganizing the industry by introducing multiple regional DISCOMs and allowing private DISCOMs in certain regions is the way forward. These DISCOMs would also compete to offer more options to energy-banking consumers.

These reforms would improve the reliability and cost-effectiveness of electricity for manufacturers while supporting the financial stability of DISCOMs.

Conclusion

India’s ambitious goals for manufacturing, particularly for high-end sectors, critically depend on a reliable and rationally priced electricity supply. Our analysis reveals that the financial distress of state-owned DISCOMs, driven by politically motivated subsidies and cross-subsidization, creates a dual challenge for manufacturers: unreliable power and high prices. When manufacturers seek alternatives through open access or captive generation, they face multiple barriers.

The success of our proposed reforms—instituting direct-benefit transfers, easing regulations on alternative power access, and reorganizing the distribution sector—hinges on political will and effective implementation. The entrenched nature of subsidies and complex political economy of the power sector present significant hurdles. Nevertheless, as India positions itself as a global manufacturing hub, addressing these electricity supply challenges is paramount for creating an environment conducive to industrial growth.

Notes

[1] Central Electricity Authority, All India Statistics Report (2020–21) (New Delhi, India: Ministry of Power, 2022).

[2] Central Electricity Authority, Electricity Tariff & Duty & Average Rates of Electricity Supply in India (New Delhi, India: Ministry of Power, 2023).

[3] F. Zhang, In the Dark: How Much Do Power Sector Distortions Cost South Asia? (World Bank, 2019).

[4] Prayas Energy Group, Electricity Supply Monitoring Initiative, August 2021.

[5] The Indian electricity system generally classifies consumers into four main categories: agricul- tural, domestic, commercial, and industrial. Manufacturers and associated firms in the supply chain typically fall in the commercial and industrial categories. In FY 2021/22, commercial and industrial consumers consumed 49.45% of India’s electricity supply. Data from Ministry of Statistics and Programme Implementation, Government of India, Energy Statistics India—2023 (New Delhi, India: National Statistical Office, 2023).

[6] Zhang, In the Dark.

[7] Hunt Allcott, Allan Collard-Wexler, and Stephen D. O’Connell, “How Do Electricity Shortages Affect Industry? Evidence from India,” American Economic Review 106, no. 3 (2016): 587–624. This estimate is based on data from the Annual Survey of Industries, which tracks plant-level production metrics such as revenue, employment, input costs, and production volumes, alongside electricity-shortage reports from the Central Electricity Authority.

[8] World Bank, Enterprise Survey (database), “India, 2022,” accessed November 18, 2024, https://www.enterprisesurveys.org/en/data/exploreeconomies/2022/india.

[9] Central Electricity Authority, Guidelines and Best Practices for Operation & Maintenance of Distribution Transformers (New Delhi: Ministry of Power, 2023); and Jaspreet Singh Maan and Sanjeev Singh, “Transformer Failure Analysis: Reasons and Methods,” International Journal of Engineering Research & Technology 4, no. 15 (2016): 1–5.

[10] “Over 27k Transformers across U. P. Suffer Damage within 25 Days,” editorial, Hindustan Times, August 1, 2023.

[11] “Power Cuts Reduce Mfg Industry Output,” editorial, Times of India, June 3, 2024.

[12] “Explained: Why India Is Facing Longest Power Cuts in Six Years,” editorial, Times of India, April 30, 2022.

[13] National Power Portal Dashboard, https://npp.gov.in/dashBoard/ud-map-dashboard.

[14] Nikhil Tyagi and Rahul Tongia, “Getting India’s Electricity Prices ‘Right’: It’s More than Just Violations of the 20% Cross-Subsidy Limit” (CSEP Impact Series 062023-02, Centre for Social and Economic Progress, New Delhi, India, 2023).

[15] The Electricity Act of 2003 replaced the Electricity Act of 1910, the Electricity Supply Act of 1948, and the Electricity Regulatory Commission Act of 1998. See Government of India, Ministry of Power, “Power Sector at a Glance ALL INDIA” (dataset), last updated on June, 12, 2023, https://powermin.gov.in/en/content/power-sector-glance-all-india.

[16] The Electricity Act of 2003 § 14.

[17] The Electricity Act of 2003 § 42.

[18] Government of India, Ministry of Power, “Power Sector at a Glance ALL INDIA.”

[19] Power Finance Corporation Ltd., Report on Performance of Power Utilities 2022–23 (New Delhi, India: Ministry of Power, 2024).

[20] Tyagi and Tongia, “Getting India’s Electricity Prices ‘Right.’”

[21] Power Finance Corporation Ltd., Report on Performance of Power Utilities 2022–23.

[22] Power Finance Corporation Ltd., Report on Performance of Power Utilities 2022–23.

[23] Sunainaa Chadha, “Explained: Punjab and UP Govt Are Doling out Free Electricity Ahead of Elections, but Who Will Bear This Cost?,” Times of India, January 11, 2022.

[24] V. Raghavendra, “Andhra Pradesh Govt Bearing Subsidy Burden to Spare Consumers of Power Tariff Hike, Says Energy Minister,” The Hindu, March 26, 2023.

[25] Prateek Aggarwal, Anjali Viswamohanan, Danwant Narayanaswamy, and Shruti Sharma, Unpacking India’s Electricity Subsidies: Reporting, Transparency, and Efficacy (International Institute for Sustainable Development, December 2020).

[26] Daljit Singh and Rahul Tongia, “Reforming Electricity Distribution in India: Understanding Delicensing and Retail Competition” (CSEP Discussion Note 7, Centre for Social and Economic Progress, New Delhi, India, 2021).

[27] Tyagi and Tongia, “Getting India’s Electricity Prices ‘Right.’”

[28] “Overpayment” here means the tariff paid is set above the average cost of supply; and “under- payment” means the tariff paid is below the average cost of supply. Tyagi and Tongia, “Getting India’s Electricity Prices ‘Right.’”

[29] Authors’ calculations based on data from Central Electricity Authority and Power Finance Corporation reports.

[30] H. Ron Chan, Edward John Manderson, and Fan Zhang, “Energy Prices and International Trade: Incorporating Input-Output Linkages” (World Bank Policy Research Working Paper 8076, World Bank, 2017).

[31] This number is the gap between the average cost of supply and the average revenues received by the DISCOM in cash. Power Finance Corporation Ltd., Report on Performance of Power Utilities 2022–23.

[32] Power Finance Corporation Ltd., Report on Performance of Power Utilities 2022–23.

[33] Authors’ calculations based on data from the Government of India, 12th Annual Integrated Rating & Ranking Report (New Delhi, India: Ministry of Power, 2024).

[34] Rajesh Gupta and Atulan Guha, “Electricity Trade at Exchanges of the World: Contextual Analysis of Indian Electricity Exchanges,” Indian Institute of Management Bangalore Management Review (October 2024).

[35] Manabika Mandal, Sreekumar Nhalur, and Ann Josey, “The Critical Role of State Government Revenue Subsidy in Electricity Supply,” Prayas Energy Group, October 2020.

[36] Electricity Rules of 2005 § 3, issued by the Indian central government under The Electricity Act of 2003 § 176 .

[37] IEEFA and JMK Research, Banking Restrictions on Renewable Energy Projects in India: Impact on Open-Access Market, 2021.

[38] A kilowatt (kW) is equal to 1,000 watts, roughly the power needed to run a small appliance like a microwave. A megawatt (MW) is 1,000 kilowatts and is used to measure the output of power plants or the electricity consumption of a large building or industrial facility.

[39] The Electricity (Promoting Renewable Energy through Green Energy Open Access) Rules, § 2(b), 2022.

[40] According to § 32 of the Electricity Act of 2003, the State Load Despatch Centre is the apex body responsible for ensuring the integrated operation of the power system within a state. It manages the scheduling of electricity, monitors grid operations, maintains transmission records, supervises the intrastate transmission system, and oversees real-time electricity flow. State regulations contain specific provisions regarding application to State Load Despatch Centres.

[41] Nikhil Sharma, “Streamlining Open Access: An Alternative to Scaling Renewables in India,” Council on Energy, Environment, and Water, March 2020.

[42] Rishabh Sethi, Balaji Raparthi, and Ashish Kumar Sharma, Open Access: Stakeholders’ Perspective (New Delhi, India: The Energy and Resources Institute, 2020).

[43] Central Electricity Regulatory Commission, “Staff Paper on National Open Access Registry: Technology Solution to Short-Term Open Access Process,” November 2016.

[44] “Telangana Government’s Regulatory Hindering Solar Open Access Progress,” editorial, Telangana Today, November 9, 2024.

[45] Maharashtra State Electricity Distribution Company Limited v. Messrs JSW Steel Limited, Civil Appeal Nos. 5074–5075 of 2019, Supreme Court of India (December 10, 2021).

[46] Jyoti Gulia, Akhil Thayillam, Prabhakar Sharma, and Vibhuti Garg, India’s Renewable Energy Open Access Market: Trends and Outlook. Demand from Commercial & Industrial Sector Is Helping the Market Grow Despite Policy Hurdles (Institute for Energy Economics and Financial Analysis, August 2022).

[47] Maria Chirayil, “TANGEDCO’s Proposed Capital Investment Plan for FY20 to FY22: Need for Serious Scrutiny and Continuous Monitoring,” Prayas Energy Group, April 2020.

[48] “RE Waivers,” CEEW Center for Energy Finance, July 2023.

[49] Maria Chirayil, “Caught in a Whirlwind: A Commentary on Competing Interests and Regulatory Lacunae in the Provision of Wind Energy Banking in Tamil Nadu,” Prayas Energy Group, 2022.

[50] Forum of Regulators, Developing Model Regulations on Methodology for Calculation of Open Access Charges and Banking Charges for Green Energy Open Access Consumers (New Delhi, India: Forum of Regulators, 2022), 67.

[51] Forum of Regulators, Developing Model Regulations, 63.

[52] Forum of Regulators, Developing Model Regulations, 71.

[53] IEEFA and JMK Research, Banking Restrictions on Renewable Energy Projects in India.

[54] Forum of Regulators, Developing Model Regulations, 76.

[55] Gulia, Thayillam, Sharma, and Garg, India’s Renewable Energy Open Access Market.

[56] Shivani Kokate and Ann Josey, “Electricity Duty on Captive: A Near Term Source for DISCOM Financial Support?,” Prayas Energy Group, April 22, 2022.

[57] PTI, “CIL’s Coal Supply to Captive Power Plants, Cement Sector Slips in May,” Business Today, June 5, 2022; and Chetan Chauhan, “Coal Shortage, Heatwave: States Face Worst Power Crisis in 6 Years,” Hindustan Times, April 29, 2022.

[58] Rishabh Sharma, “Coal Shortage: How Power Crunch May Affect Non-power Industries,” India Today, October 13, 2021.

[59] “Transitional gains trap” refers to the phenomenon in which government-granted privileges become politically difficult to repeal because it would cause significant losses to the entrenched beneficiaries. Gordon Tullock, “The Transitional Gains Trap,” Bell Journal of Economics 6, no. 2 (1975): 671–78.